Samsung Electronics is expected to report a substantial recovery in quarterly profit, with projections of over a four-fold increase to 10.33 trillion won ($7.67 billion) for the quarter ending September 30, according to analysts. However, the company’s recovery momentum appears to be weakening, primarily due to its slower response to the surge in demand for AI chips. Despite a significant improvement from the 2.43 trillion won reported a year earlier, Samsung’s latest profit estimate remains largely unchanged from the previous quarter’s 10.44 trillion won.

The global semiconductor market, recovering from last year’s downturn, has seen a boost in demand for AI server chips, though conventional chip demand, particularly for smartphones and PCs, is softening. Samsung faces increasing pressure from competitors like SK Hynix and Micron, who are aggressively competing in the AI chip space, especially in supplying chips to industry leaders like Nvidia. This competition, along with geopolitical risks tied to Samsung’s higher exposure to China and traditional mobile chips, is making the company more vulnerable, according to analysts.

Samsung’s chip division, the core of its business, is projected to swing back to a 5.5 trillion won operating profit for the third quarter, a significant leap from the loss incurred a year ago. Yet, this represents a 15% decline from the preceding quarter, partially due to provisions set aside for employee bonuses. Samsung’s struggle to capture the high-margin AI chip market and growing competition in commodity DRAM chips could further hurt its market position. Macquarie Equity Research analyst Daniel Kim noted that Samsung risks losing its position as the top DRAM vendor if the commodity DRAM market weakens further.

Meanwhile, Samsung’s non-memory chip operations, including chip designing and contract manufacturing, are expected to remain in the red, unable to compete with TSMC, which has stronger ties to major players like Apple and Nvidia. The company’s difficulties extend beyond chips, with its premium foldable phone sales expected to underperform, reflecting increased competition from Chinese brands like Huawei. Samsung’s mobile and network businesses are projected to post a 2.6 trillion won operating profit for the third quarter, a 20% drop from the same period last year.

Additionally, Samsung has reportedly cut up to 30% of its overseas staff in certain divisions, signaling further challenges ahead for the tech giant. Samsung’s shares have fallen 23% this year, significantly underperforming its rival SK Hynix, which has seen its shares rise by the same percentage.

Samsung will announce its preliminary third-quarter earnings on Tuesday, with full financial figures expected later in the month.

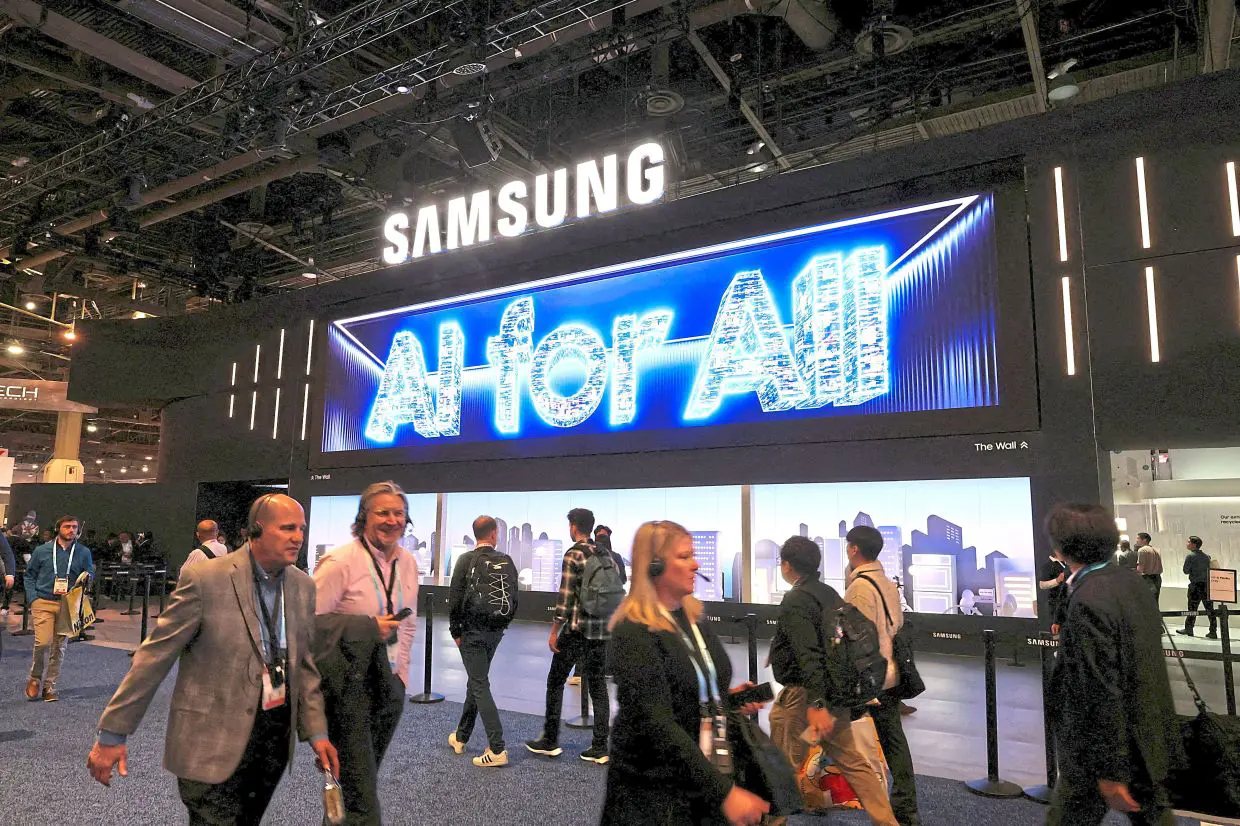

Featured Image courtesy of The Star

Follow us for more updates on Samsung’s growth.