Adam Neumann, former CEO of WeWork, has proposed a bid exceeding $500 million to purchase the company from bankruptcy. Despite the substantial offer laid on the table, doubts linger over Neumann’s ability to secure the necessary financing and creditor support for the bid’s success, presenting a significant test of Neumann’s resilience and capability to navigate the intricate challenges that lie ahead.

Neumann’s bid faces skepticism primarily due to uncertainties regarding his financial backing and the broader concerns stemming from his controversial tenure at WeWork. As the company is mid-restructuring, assessing the bid’s viability adds complexity to the situation.

Who is Financing Neumann’s Bid?

Rithm Capital, an investment firm that recently expanded its portfolio by acquiring Sculptor Capital Management, emerges as a potential financier in Neumann’s bid. However, the firm’s involvement is reportedly in its initial stages, with a comprehensive due diligence process yet to be undertaken. This tentative commitment reflects the broader uncertainty surrounding the solidity of Neumann’s financial arrangements. Previous instances where Neumann cited potential financiers in discussions with WeWork’s advisors—only for these entities to either deny involvement or remain at a preliminary stage of commitment—add to the hesitancy surrounding his current bid.

The situation is further complicated by conflicting reports regarding other financial backers. High-profile entities like Dan Loeb’s Third Point and Baupost Group were mentioned in earlier stages as potential financiers. However, these mentions have not translated into concrete support, with Third Point swiftly distancing itself from the bid and Baupost Group not progressing beyond preliminary discussions.

Amid these challenges, WeWork maintains a neutral stance, emphasizing its routine engagement with third-party interest and its commitment to the company’s long-term wellbeing. Neumann, for his part, has not enlisted the services of bankers or financial advisors, opting instead to navigate the acquisition through direct representation by legal counsel.

His involvement with Flow, a startup aimed at reinventing home ownership and community building, which also features in the bid for WeWork, adds another dimension to the narrative. Despite Flow’s considerable backing by Andreessen Horowitz, the firm’s role and intentions in the context of the WeWork bid remain part of the unfolding story.

Challenges Ahead for Neumann’s WeWork Bid

As the bankruptcy proceedings of WeWork continue in New Jersey, without a clear path to resolution, Neumann’s bid arrives at a critical juncture. His previous leadership, marked by a frenetic pace of fundraising and spending culminating in a failed IPO attempt, has left a tarnished reputation.

With WeWork’s largest investor at the time, SoftBank, playing a central role in Neumann’s ouster and now among the creditors in bankruptcy court, the dynamics of Neumann’s attempt to reclaim the company he founded are fraught with historical complexities and present-day challenges.

Related News:

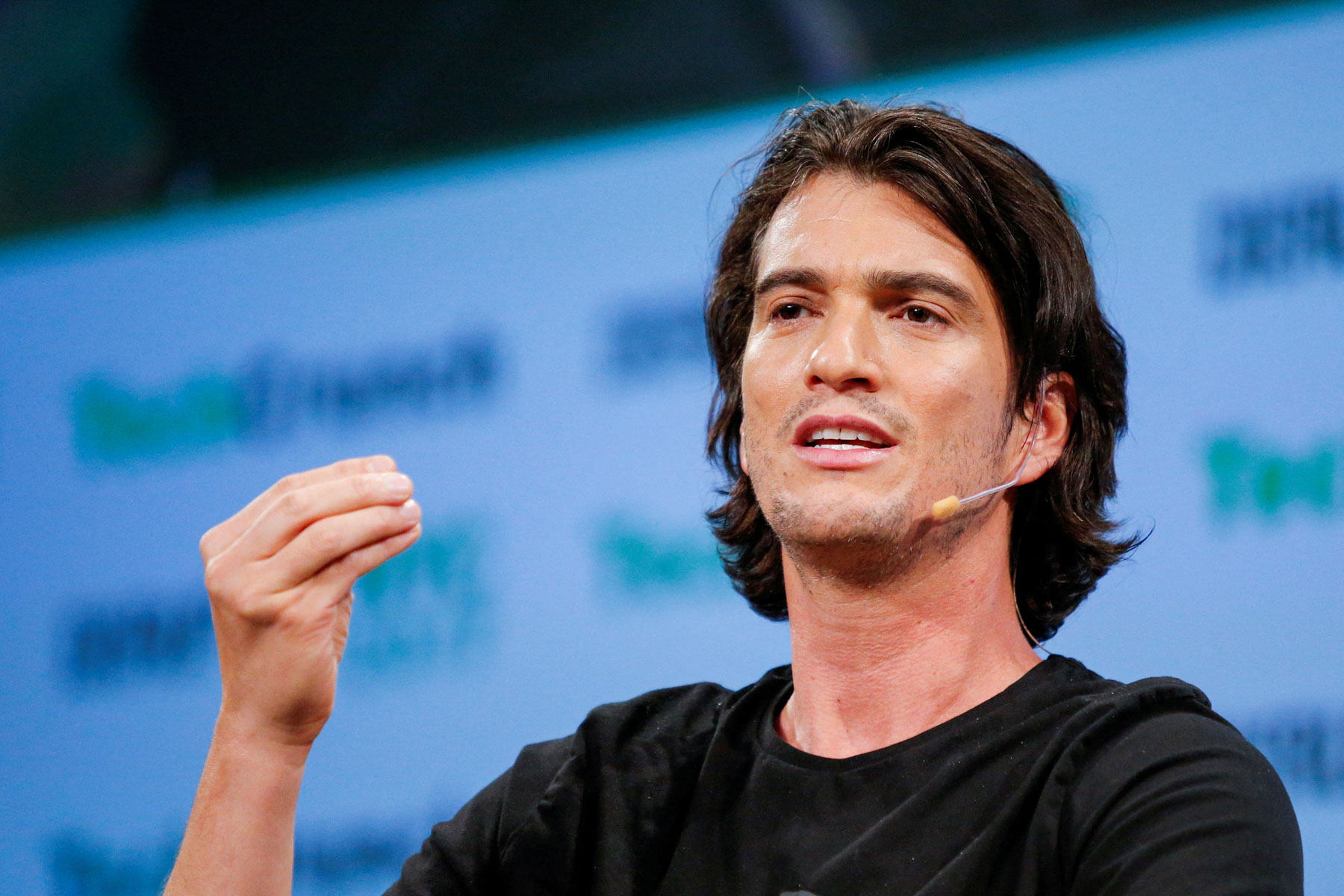

Featured Image courtesy of Eduardo Munoz/REUTERS