Nvidia’s stock dropped more than 6% on Thursday after the company’s third-quarter forecast fell short of high investor expectations, despite remaining confident in the generative AI trend that has driven the chipmaker’s strong performance throughout the year. Nvidia projected third-quarter gross margins that could miss market estimates, with revenue mostly aligning with expectations. However, Nvidia indicated that production of its next-generation Blackwell chips would ramp up in the fourth quarter, alleviating some investor concerns.

Shares of other semiconductor companies showed mixed results, with Broadcom down 0.8% and Advanced Micro Devices falling 0.6%, while Arm’s stock increased by 5.3%. Despite the recent dip, Nvidia’s shares remain up by 137% this year, marking it as a key player in the U.S. stock rally. The company’s robust performance has been supported by high quarterly revenue forecasts, leading investors to set high growth expectations.

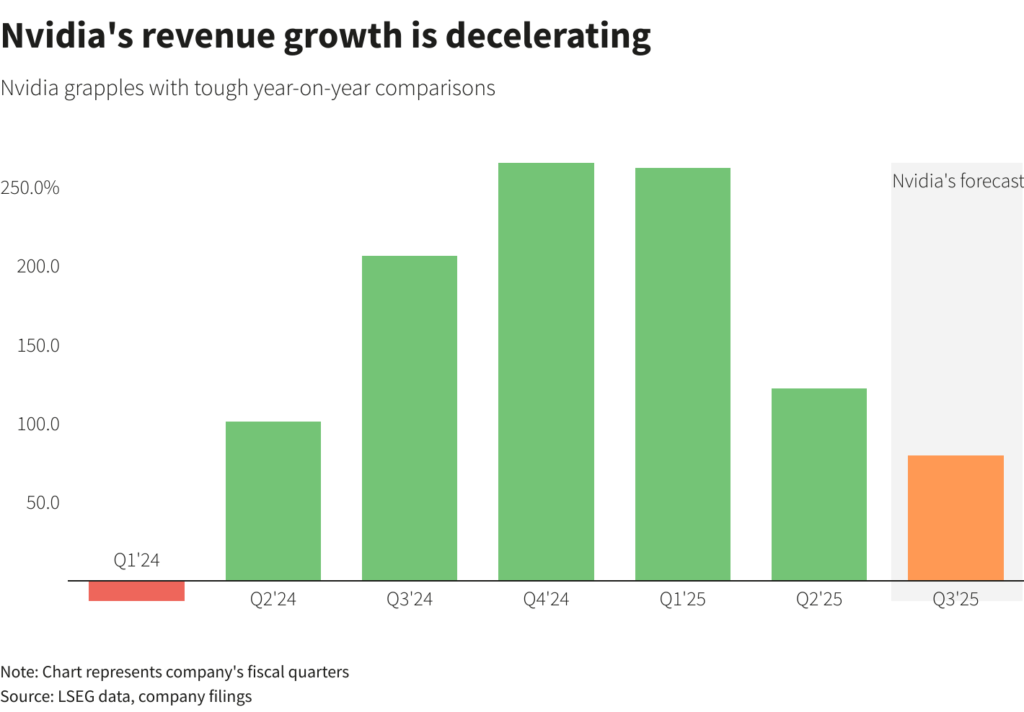

According to JJ Kinahan, CEO of IG North America, Nvidia’s strong second-quarter earnings and a new $50 billion share buyback were overshadowed by overly high market expectations. Analyst Dan Coatsworth from AJ Bell suggested that investors might have considered the highest end of the estimate range rather than the average analyst forecasts as the standard for Nvidia’s performance. Nvidia’s third-quarter revenue forecast of $32.5 billion, plus or minus 2%, implies 80% growth from the same quarter last year, falling short of the top market estimate of $37.9 billion.

Despite the sell-off, some analysts view the dip as an opportunity to buy. Nancy Tengler, CEO of Laffer Tengler Investments, noted that Nvidia has experienced more significant declines following earnings reports in the past, seeing the current drop as a chance to accumulate stock. Meanwhile, shares of other major tech companies showed resilience, with Amazon and Apple closing higher, while Alphabet dipped by 0.7%.

Analyst Ben Barringer from Quilter Cheviot emphasized that the long-term potential of AI remains intact, with Nvidia’s numbers not signaling a significant setback. Recent concerns about slow returns from AI investments have affected other tech giants like Microsoft and Alphabet, whose shares have traded lower since their quarterly reports last month. The delay in ramping up production of Nvidia’s Blackwell chips to the fourth quarter is seen as manageable, given the ongoing demand for its current Hopper chips.

Concerns also arose over increased regulatory scrutiny after Nvidia disclosed information requests from U.S. and South Korean regulators, adding to inquiries from the EU, UK, and China. Analysts suggest that recent regulatory successes, such as the DOJ’s win over Google, could prompt investors to pay closer attention to potential regulatory interventions in the tech sector.

The reaction to Nvidia’s earnings report might influence market sentiment during September, a historically volatile month for stocks. The S&P 500 has averaged a 0.8% decline in September since World War Two, the worst performance of any month, according to CFRA data. Ahead of its earnings report, Nvidia was valued at 36 times earnings, which is below its five-year average of 41 but still higher than the S&P 500’s current trading at 21 times expected earnings.

Featured Image courtesy of TechCrunch

Follow us for Nvidia’s latest market moves and AI developments