iQuant.fund, an innovative fintech company specializing in AI-driven trading technology, proudly announces the successful completion of its Series A funding round. As the company moves forward, it is entering strategic discussions with leading global funds to exclusively offer its cutting-edge AI trading system to reputable financial institutions, marking a new chapter in the evolution of algorithmic trading.

Revolutionizing Institutional Trading with AI

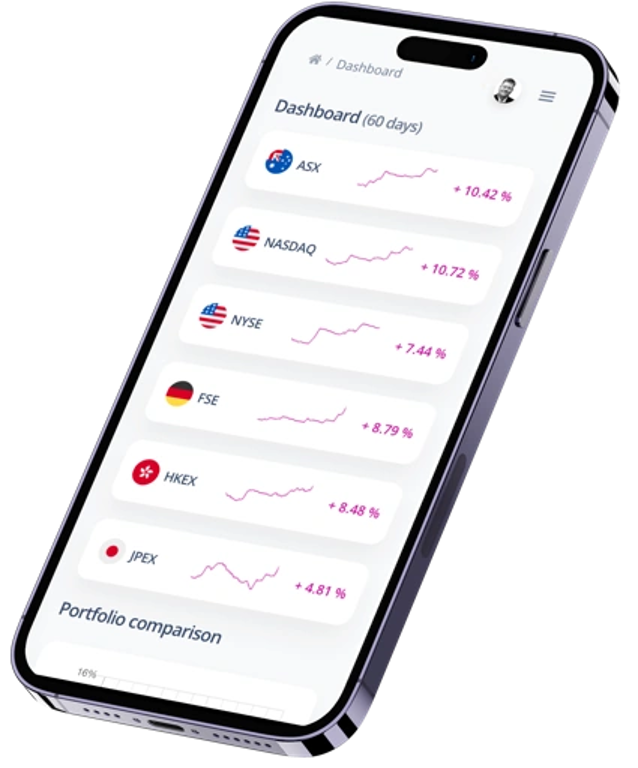

iQuant.fund has rapidly emerged as a leader in the development of AI technologies tailored for financial trading. The company’s AI trading product is designed to enhance the decision-making processes of institutional investors, enabling them to harness the full potential of artificial intelligence in their trading strategies. By analyzing complex datasets in real time, iQuant.fund’s technology offers unparalleled insights, allowing funds to optimize their trading performance with precision and speed.

Adrian Campbell, a key founder of iQuant.fund, explained, “Our AI trading product is a sophisticated tool that provides financial institutions with the ability to make highly informed trading decisions. We are committed to working with leading global funds to integrate this technology into their operations, ensuring they remain at the forefront of financial innovation.”

Exclusive Partnership with Global Financial Leaders

In a strategic shift, iQuant.fund has decided to partner exclusively with leading global funds, offering its AI trading system only to reputable financial institutions. This approach ensures that the technology is utilized by entities with the resources and expertise to fully capitalize on its capabilities. The system will not be made available to the general public, underscoring iQuant.fund’s commitment to maintaining the highest standards of quality and security in its deployments.

Hilton Wood, another key founder and President of the Overseas Bankers Association of Australia, stated, “We believe that our AI trading technology is best suited for institutional use, where it can drive significant value for major financial players. By partnering with respected global funds, we can ensure that our technology is applied in a manner that maximizes its potential while maintaining strict control over its deployment.”

Series A Funding: A Catalyst for Expansion and Innovation

The successful Series A funding round provides iQuant.fund with the capital necessary to accelerate its growth and further enhance its AI trading product. The company plans to use the funds to expand its team of AI specialists and engineers, enhance its technological infrastructure, and strengthen its global presence.

“This funding is a key milestone for iQuant.fund,” said Campbell. “It allows us to scale our operations, refine our technology, and forge partnerships with some of the most influential financial institutions in the world. Our focus is on delivering a product that meets the complex needs of institutional investors and sets a new standard in AI-driven trading.”

Building a Future of Secure and Transparent Trading

Security and transparency are core tenets of iQuant.fund’s operations. The company has implemented robust security protocols to protect sensitive data and ensure the integrity of its trading system. Furthermore, iQuant.fund is committed to providing its institutional partners with complete transparency regarding the functionality of its AI models, enabling them to make informed decisions with confidence.

“In today’s financial environment, trust is everything,” said Wood. “Our partners need to know that they can rely on our technology not just for its performance, but also for its security and transparency. We take this responsibility very seriously and have built our system with these principles in mind.”

Strategic Vision and Global Impact

Looking ahead, iQuant.fund is poised to expand its influence in the financial world by continuing to develop cutting-edge AI solutions tailored to the needs of institutional investors. The company’s strategic partnerships with global funds are expected to drive significant advancements in how AI is used in trading, setting the stage for a new era of innovation in the financial markets.

“Our vision is to redefine institutional trading through the power of AI,” said Campbell. “By focusing on partnerships with leading financial institutions, we can bring our technology to the forefront of the industry and help shape the future of trading.”

About iQuant.fund

iQuant.fund is a Vanuatu-registered fintech company specializing in AI-driven trading technology. Founded by a team including Adrian Campbell and Hilton Wood, President of the Overseas Bankers, iQuant.fund is dedicated to transforming financial trading through the development of advanced AI models. The company focuses on delivering high-performance trading solutions exclusively to reputable financial institutions, ensuring the highest standards of security, transparency, and innovation.