Nvidia CEO Jensen Huang attributed the company’s success in the artificial intelligence (AI) chip market to strategic decisions made over a decade ago. These decisions involved investing billions of dollars in AI and assembling a formidable team of engineers. Huang’s remarks were made during the Q&A session of Nvidia’s annual shareholder meeting, where the company has seen its stock surge by over 200% in the past year.

Huang explained that Nvidia’s foresight and substantial investments in AI technology over the past ten years have positioned the company as a leader in the AI chip industry. This strategy involved not only financial investments but also the recruitment and retention of a highly skilled engineering team dedicated to advancing AI capabilities.

“Our advantage in AI chips is the result of a bet we made over ten years ago, focusing on significant AI investments and building a team of thousands of engineers,” Huang stated.

Nvidia’s stock performance has been nothing short of remarkable, reflecting the market’s confidence in the company’s AI strategy. Over the past year, Nvidia’s stock has soared by more than 200%, driven by its dominance in the AI chip market. Recently, the company executed a 10-for-1 stock split and briefly reached a $3 trillion valuation, making it the most valuable public company at one point.

During the shareholder meeting, Huang addressed questions about the company’s competition. Traditional chipmakers and startups are developing products to challenge Nvidia’s significant market share, which exceeds 80% in the AI chip sector. Despite this competitive landscape, Huang expressed confidence in Nvidia’s strategy to maintain its leadership.

One of the key elements of Nvidia’s strategy, as highlighted by Huang, is the company’s transformation from a gaming-focused enterprise to a data center-centric business. This shift has enabled Nvidia to capitalize on the growing demand for AI in various sectors, including industrial robotics and cloud computing.

Nvidia is not resting on its laurels. The company is actively exploring new markets for its AI technology. By partnering with every major computer manufacturer and cloud provider, Nvidia aims to extend its AI applications to areas such as industrial robotics, healthcare, and autonomous vehicles.

Huang emphasized the economic advantages of Nvidia’s AI chips. He argued that while competitors might offer less expensive chips, Nvidia’s products provide the lowest total cost of ownership due to their superior performance and efficiency.

“Our AI chips offer the lowest total cost of ownership, making them more economical considering their performance and cost to run,” Huang explained.

Huang also discussed the concept of the “virtuous circle,” a term used in the technology industry to describe a self-reinforcing cycle where a platform with a large user base continues to grow and improve, attracting even more users. Nvidia’s widespread adoption by major cloud providers and computer manufacturers has created a large install base, enhancing the platform’s value for developers and customers.

“The NVIDIA platform is broadly available through every major cloud provider and computer maker, creating a large and attractive install base for developers and customers, which makes our platform more valuable to our customers,” Huang noted.

At the shareholder meeting, Nvidia shareholders expressed their satisfaction with the company’s performance. They approved a nonbinding vote on executive compensation, known as “say on pay.” This vote reflects shareholders’ approval of the company’s compensation practices, which include a mix of salary and restricted stock units.

In the fiscal year 2024, Jensen Huang received a compensation package valued at approximately $34 million. This package represents a 60% increase from the previous year, highlighting the company’s recognition of Huang’s leadership and the company’s success. The compensation package includes a combination of salary, performance-based bonuses, and various types of restricted stock units.

- AI Investment Strategy: Nvidia’s long-term investments in AI have paid off, establishing it as a market leader.

- Stock Performance: Nvidia’s stock has surged over 200% in the past year, with a recent 10-for-1 stock split.

- Market Leadership: Despite increasing competition, Nvidia maintains over 80% market share in AI chips.

- Strategic Shift: The company has transitioned from a gaming focus to a data center-centric approach.

- Executive Compensation: CEO Jensen Huang’s compensation package increased by 60% to $34 million in fiscal year 2024.

Nvidia’s strategic decisions and substantial investments in AI over the past decade have clearly positioned it as a leader in the AI chip market. Despite increasing competition, the company’s transformation and focus on data centers, coupled with its partnerships across the tech industry, have solidified its dominant position. Nvidia’s continued innovation and expansion into new markets will likely sustain its leadership in AI technology for the foreseeable future.

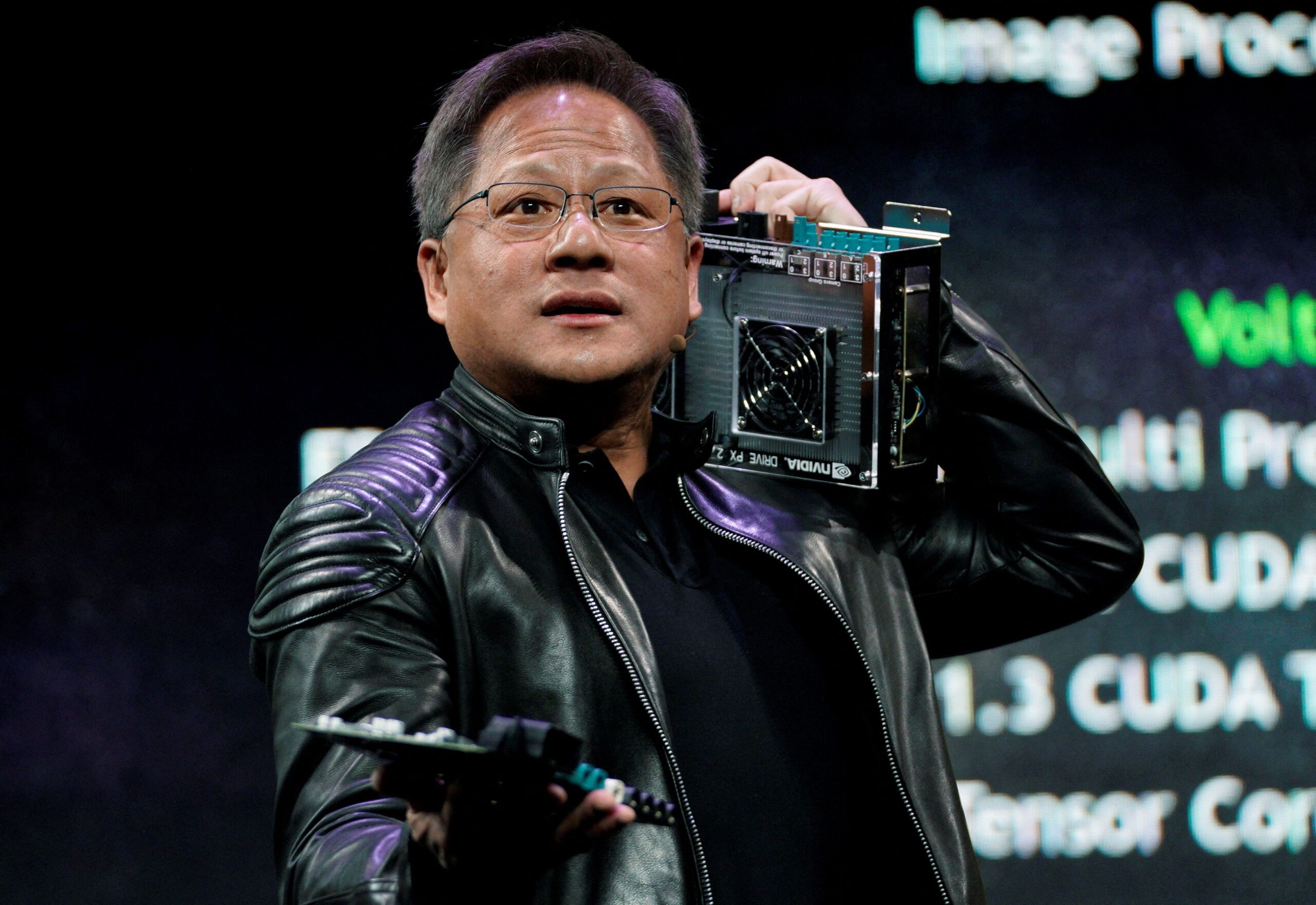

Featured Image courtesy of The National