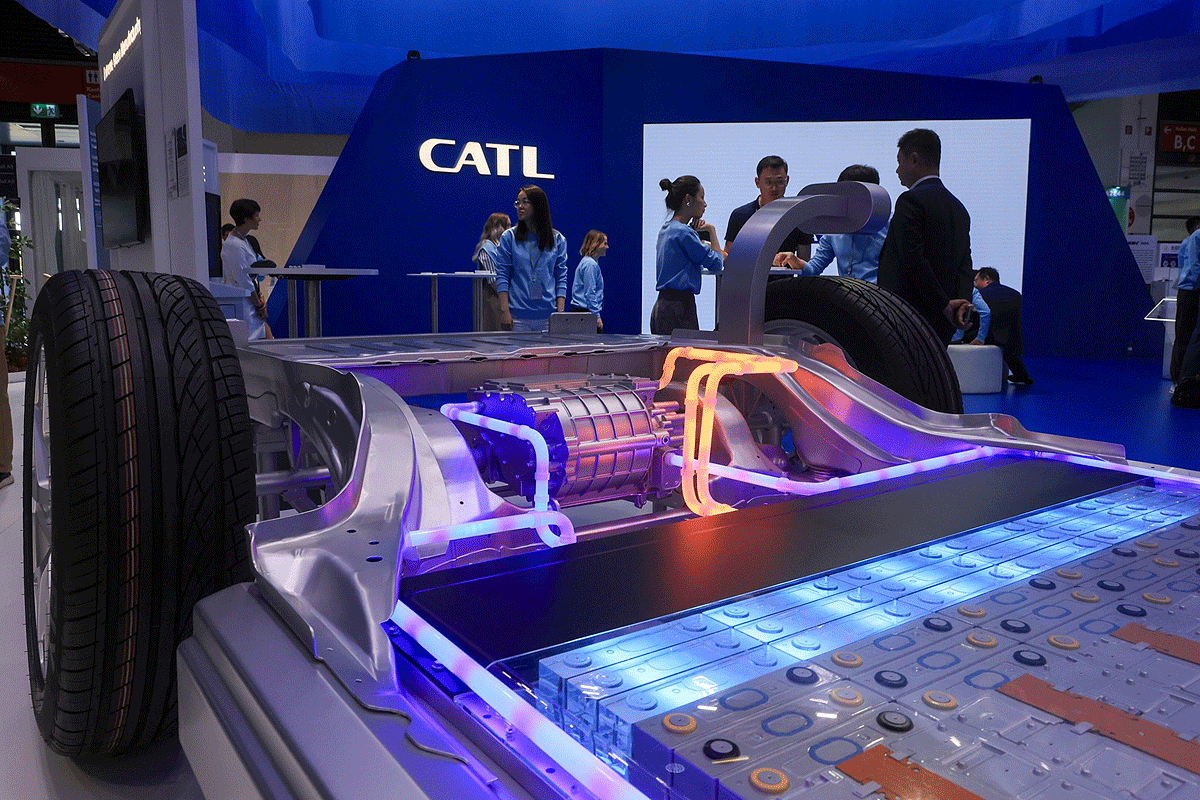

China’s electric vehicle (EV) battery giants, CATL and BYD, are making significant strides in the burgeoning market for stationary energy storage. Both companies are leveraging their expertise and resources to meet the increasing global demand for energy storage solutions.

CATL has maintained a commanding lead in the global market for energy storage batteries since 2021. According to its annual report, CATL holds over 40% of the market share in battery deliveries for energy storage. This impressive achievement is attributed to the company’s partnerships with major clients, including state-owned power companies like Huaneng and leading energy storage system manufacturers such as Sungrow Power Supply.

In 2023, CATL experienced a substantial increase in its energy storage battery deliveries, which soared by 46.8% to 69 gigawatt-hours (GWh). This growth rate surpasses the 32.6% increase in their EV battery deliveries, highlighting the rapid expansion of their energy storage business. Consequently, energy storage batteries now constitute 17.6% of CATL’s total battery sales volume, up from 12.5% in 2021.

One notable collaboration that underscores CATL’s prominence in the energy storage market is its partnership with Tesla. CATL will supply battery cells and packs to Tesla’s export-oriented Megapack storage plant in Shanghai. This plant is set to commence production in early 2025, aiming to manufacture 10,000 Megapacks annually, with a combined storage capacity of 40 GWh.

- Global Market Share (2021 onwards): Over 40%

- Energy Storage Battery Deliveries (2023): 69 GWh

- Growth Rate (Energy Storage Batteries, 2023): 46.8%

- Growth Rate (EV Batteries, 2023): 32.6%

- Proportion of Total Battery Sales (2023): 17.6%

| Metric | 2021 | 2023 |

|---|---|---|

| Energy Storage Battery Market Share | 40%+ | 40%+ |

| Energy Storage Battery Deliveries (GWh) | N/A | 69 |

| Growth Rate (Energy Storage) | N/A | 46.8% |

| Growth Rate (EV Batteries) | N/A | 32.6% |

| Energy Storage as % of Total Sales | 12.5% | 17.6% |

BYD, another key player in the EV battery market, is also capitalizing on the growing demand for energy storage solutions. In 2023, BYD delivered 22 GWh of batteries for energy storage, marking a 57% increase from the previous year. This growth rate is notably higher than the 15.6% growth in their EV battery shipments.

Despite the rapid expansion of their energy storage business, BYD’s EV battery shipments still dominate their overall battery sales. In 2023, BYD shipped a total of 135 GWh of EV batteries. The company’s significant growth in the energy storage sector reflects its strategic focus on diversifying its product portfolio and addressing the global shift towards renewable energy sources.

- Energy Storage Battery Deliveries (2023): 22 GWh

- Growth Rate (Energy Storage Batteries, 2023): 57%

- Growth Rate (EV Batteries, 2023): 15.6%

- Total EV Battery Shipments (2023): 135 GWh

| Metric | 2022 | 2023 |

|---|---|---|

| Energy Storage Battery Deliveries (GWh) | N/A | 22 |

| Growth Rate (Energy Storage) | N/A | 57% |

| Growth Rate (EV Batteries) | N/A | 15.6% |

| Total EV Battery Shipments (GWh) | N/A | 135 |

The energy storage market is not only dominated by CATL and BYD but also features significant contributions from smaller players. Companies like EVE, REPT, and HITHIUM have reported remarkable growth in their energy storage battery sales. In 2023, these companies achieved over 100% growth rates in their energy storage battery sales, capturing 11%, 8%, and 7% of the 185 GWh global market, respectively.

Key Figures for Smaller Players:

- EVE’s Market Share: 11%

- REPT’s Market Share: 8%

- HITHIUM’s Market Share: 7%

Several factors contribute to the rapid growth of the energy storage market:

- Rising Demand for Renewable Energy: As countries worldwide commit to reducing carbon emissions and transitioning to renewable energy sources, the need for efficient energy storage solutions has surged.

- Technological Advancements: Continuous advancements in battery technology have improved the efficiency, capacity, and affordability of energy storage systems.

- Government Policies and Incentives: Various governments are implementing policies and offering incentives to promote the adoption of renewable energy and energy storage solutions.

- Industrial Applications: The industrial sector’s increasing reliance on renewable energy sources drives the demand for large-scale energy storage systems to ensure a stable power supply.

The future of the energy storage market looks promising, with continued growth expected in the coming years. Both CATL and BYD are well-positioned to capitalize on this trend, given their technological expertise, extensive production capabilities, and strategic partnerships.

For CATL, the partnership with Tesla for the Shanghai Megapack plant is a significant milestone. The plant’s production capacity of 10,000 Megapacks per year will considerably boost CATL’s energy storage business. Similarly, BYD’s robust growth in energy storage battery deliveries and its substantial EV battery shipments highlight its potential to become a major player in the global energy storage market.

In conclusion, China’s leading EV battery manufacturers, CATL and BYD, are making substantial inroads into the energy storage market. Their impressive growth rates, strategic partnerships, and technological advancements position them at the forefront of the global shift towards renewable energy and efficient energy storage solutions. As the demand for energy storage continues to rise, these companies are poised to play a crucial role in shaping the future of the energy storage industry.

Featured Image courtesy of Automotive News