Recent buzz on social media has reignited discussions about China potentially lifting its longstanding prohibition on Bitcoin. However, the cryptocurrency community remains largely skeptical about such a reversal happening anytime soon.

Mike Novogratz Stirs Discussion

Galaxy Digital CEO Mike Novogratz recently took to X (formerly Twitter), suggesting that China might be considering an end to its Bitcoin ban by late 2024. This marks the second time in a few weeks that Novogratz has heard such rumors, which he describes as a potentially “huge deal.

China’s relationship with Bitcoin has been tumultuous, featuring several high-profile bans:

- 2017: China banned crypto exchanges, disrupting local trading landscapes.

- 2021: An interdepartmental crackdown targeted crypto mining and transactions.

Despite these measures, China has remained a significant player in the Bitcoin mining industry, subtly contributing to the global crypto economy.

Reactions to Novogratz’s post were mixed, with many expressing skepticism:

- Doubt over Reversal: Some users highlighted China’s history of repetitive bans, suggesting that even if lifted, the ban could be reinstated.

- Critique of Complete Ban Myth: Others argued that China never fully banned Bitcoin but rather restricted certain crypto-related activities.

Academic Insight

Professor Wang Yang from the Hong Kong University of Science and Technology has criticized the logic behind China’s stringent crypto policies, especially the complete ban on crypto mining. He argues that such policies are counterproductive, driving crypto businesses abroad and benefiting foreign economies like the United States.

- Yifan He’s Skepticism: Yifan He, CEO of Red Date Technology, firmly believes that China will not allow its citizens to trade Bitcoin freely using the renminbi. He points out that such a move would be inconsistent with the reasons behind the original ban.

- Mikko Ohtamaa’s Analysis: Echoing He’s sentiments, Mikko Ohtamaa, co-founder of Trading Strategy, also doubts the rumors, suggesting that allowing crypto trading contradicts the Chinese government’s control over financial systems and could lead to unwanted capital flight.

Misconceptions About Hong Kong’s Role

Some industry observers previously speculated that the launch of spot Bitcoin and Ether ETFs in Hong Kong could open avenues for mainland Chinese investors. However, experts clarify that these ETFs do not offer such exposure due to regulatory and operational constraints.

| Event | Year | Impact |

|---|---|---|

| First Crypto Exchange Ban | 2017 | Major disruption in local trading |

| Crackdown on Crypto Mining and Transactions | 2021 | Significant blow to operational crypto entities |

| Speculation of Unbanning | 2024 | Mixed reactions and skepticism within the crypto community |

While the rumor mill continues to churn about China potentially reversing its stance on Bitcoin, the prevailing sentiment among crypto enthusiasts and experts leans towards skepticism. The complex interplay of regulatory intentions and the geopolitical landscape makes it unlikely that China will make a swift change in its approach to cryptocurrency. As the global crypto community watches closely, the situation remains a significant point of speculation and discussion.

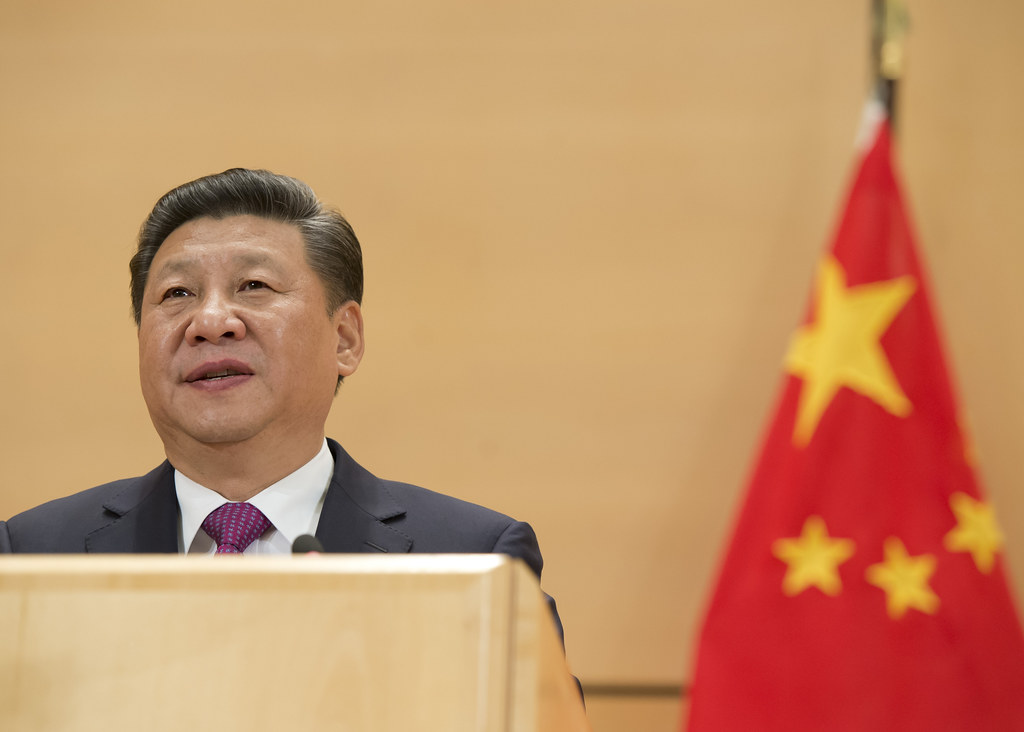

Featured image credit: UN Geneva via Flickr

Follow us for more breaking news on DMR