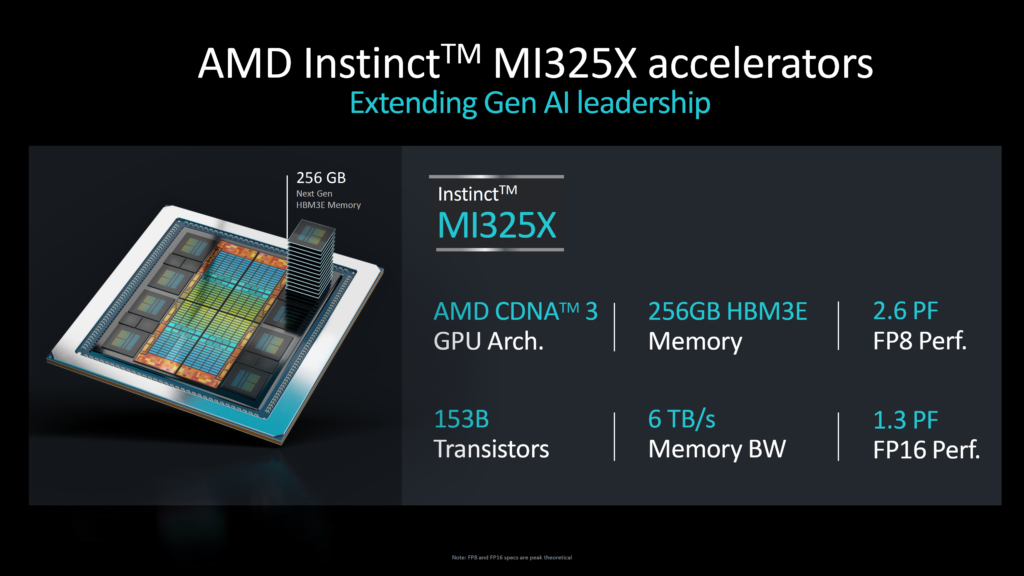

AMD introduced a new artificial intelligence chip, the Instinct MI325X, on Thursday, aiming to challenge Nvidia’s dominance in the data center GPU market. The chip is set to enter production before the end of 2024, with AMD positioning it as a competitive alternative to Nvidia’s GPUs, which have enjoyed high demand and profitability. If widely adopted, AMD’s chip could pressure Nvidia’s pricing, as Nvidia currently holds around 75% gross margins in the AI GPU sector.

The demand for AI chips has surged, driven by the need for data centers capable of handling generative AI workloads, such as OpenAI’s ChatGPT. Nvidia has maintained a stronghold on this market, but AMD, historically second in this space, now seeks to capture a significant portion of the projected $500 billion AI chip market by 2028. AMD CEO Lisa Su emphasized that the increasing investment in AI continues to surpass expectations.

While AMD did not announce new cloud customers for its Instinct GPUs during the product event, the company had previously disclosed that Meta and Microsoft are among its clients. AMD did not reveal the price of the MI325X, typically sold as part of a server package. The new AI chip is expected to rival Nvidia’s upcoming Blackwell chips, which are slated to ship in early 2024.

AMD’s strategy includes speeding up its product release schedule, with plans for a new AI chip every year. Following the MI325X, the company will launch the MI350 in 2025 and the MI400 in 2026. Despite these efforts, AMD faces a challenge in the form of Nvidia’s CUDA programming language, which has become the industry standard, locking many developers into Nvidia’s ecosystem. To counter this, AMD has been improving its ROCm software to facilitate easier migration for AI developers.

One key selling point for AMD’s MI325X is its performance with certain AI workloads, specifically models like Meta’s Llama AI, where it claims up to 40% more inference performance than Nvidia’s H200 chip. However, despite its recent product launch, AMD’s stock fell by 4% on Thursday, while Nvidia’s stock rose by about 1%.

In addition to its AI efforts, AMD also announced a new line of EPYC 5th Gen CPUs, further targeting Intel’s dominance in the server processor market. These CPUs, ranging from lower-cost models to high-end processors for supercomputers, are designed to complement AI workloads by efficiently feeding data to GPUs. AMD’s data center business saw a significant increase, with sales more than doubling in the June quarter, though AI chips only accounted for about $1 billion of its $2.8 billion data center revenue.

Featured Image courtesy of CIO Dive

Follow us for more updates on AMD’s new chip.