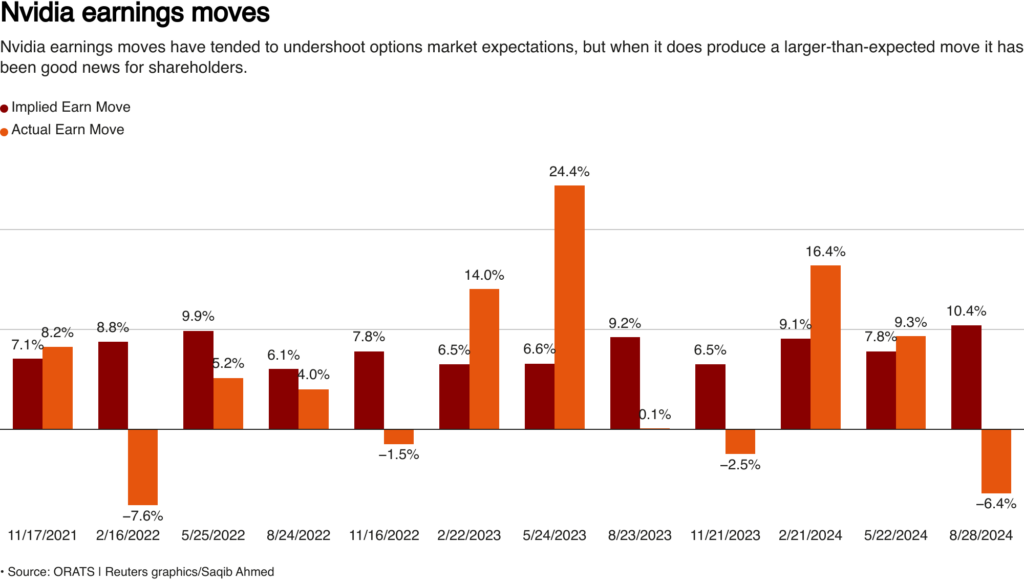

Nvidia’s market value could experience a staggering $300 billion shift following its quarterly earnings report, set to release after markets close on Wednesday. According to U.S. options market data analyzed by ORATS, traders are pricing in an 8.5% move in either direction for the AI-chipmaker’s shares. While this percentage aligns with Nvidia’s past post-earnings fluctuations, the company’s $3.44 trillion market cap makes this one of the largest potential market swings in its history.

A shift of this magnitude would surpass the market capitalization of nearly 95% of S&P 500 companies. Historically, Nvidia’s stock moves after earnings have often fallen short of expectations, but when exceeding them, the moves have skewed to the upside. ORATS founder Matt Amberson noted that five of the last 12 quarterly earnings have outperformed market predictions, all resulting in higher stock prices.

Susquehanna Financial Group strategist Christopher Jacobson highlighted that traders are currently assigning a greater probability to an upward surprise than a downward one. Nvidia, a central player in the generative AI boom, could significantly influence market sentiment with its earnings report. This comes as a recent rally in U.S. markets has begun to cool, with the S&P 500 still up 23% year-to-date despite a dip last week.

“The market will extrapolate whatever Nvidia says to the entire AI trade,” said Nancy Tengler, CEO and CIO at Laffer Tengler Investments, in a note. Nvidia’s results will be closely watched to gauge the broader momentum of AI-related investments.

The company has consistently outperformed Wall Street’s revenue expectations for eight consecutive quarters. For the third quarter, analysts expect sales to jump 82.8% year-over-year to $33.13 billion, based on data from LSEG. However, questions remain about how Nvidia plans to navigate supply chain delays and meet demand for its AI chips.

Nvidia’s stock, up 180% this year, closed at $140.15 on Monday, down 1.3%. The earnings report could either solidify its status as a market leader or temper the explosive growth narrative surrounding AI stocks.

Featured image courtesy of Finanzmarkwelt

Follow us for more updates on Nvidia’s market value.