Nvidia’s third-quarter performance exceeded Wall Street expectations, with the company reporting significant revenue growth fueled by robust demand for its artificial intelligence chips. The technology giant delivered $35.08 billion in revenue, surpassing analysts’ projections of $33.16 billion, while adjusted earnings per share came in at 81 cents, beating the forecast of 75 cents. Nvidia‘s impressive results reflect the continued rise of AI adoption across industries.

For the upcoming quarter, Nvidia forecasts revenue of $37.5 billion, slightly above the $37.08 billion predicted by analysts. This would mark a 70% year-over-year growth, although it indicates a slowdown compared to the staggering 265% growth recorded during the same period last year. Shares of Nvidia fell 2% in extended trading following the announcement.

Revenue surged 94% on an annual basis in the latest quarter, though this represents a sequential slowdown after three consecutive quarters of triple-digit growth. The bulk of this revenue originated from Nvidia’s data center division, which posted $30.8 billion in revenue, a 112% increase year-over-year. Analysts had anticipated $28.82 billion. Notably, $3.1 billion of this figure came from networking components tied to data center operations.

AI Chips Drive Revenue Boom

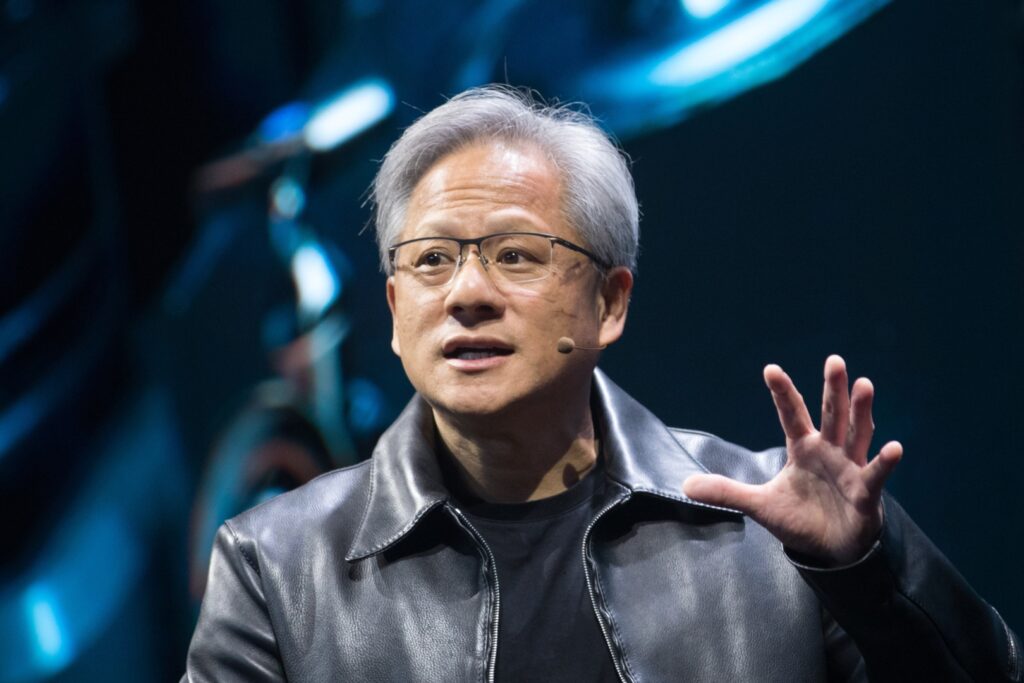

Nvidia’s dominance in the AI chip market remains a critical growth driver. Many of its largest customers, including Microsoft, Oracle, and OpenAI, have begun integrating Nvidia’s next-generation AI chip, Blackwell. According to Nvidia Chief Financial Officer Colette Kress, 13,000 Blackwell chip samples have been shipped to partners, with full production already underway. CEO Jensen Huang emphasized that demand for Blackwell chips is expected to outpace supply through fiscal 2026.

Additionally, Nvidia’s H200 AI chips saw strong sales during the quarter, underscoring the company’s ability to meet demand across multiple product lines.

Gaming and Other Segments

Nvidia’s gaming business also delivered strong results, reporting $3.28 billion in revenue, above analysts’ expectations of $3.03 billion. The rise was attributed to higher demand for GPUs for PCs and laptops and an uptick in game console chip sales. Nvidia supplies the chips used in Nintendo’s Switch console.

Smaller segments, such as automotive and professional visualization, also posted growth. Automotive revenue rose 72% to $449 million, driven by self-driving and robotics chips, while professional visualization sales increased 17% year-over-year to $486 million.

Despite the optimism surrounding AI, Nvidia faces challenges, including potential supply constraints for its Blackwell and Hopper chips. The company is preparing for demand to exceed supply in the coming fiscal years. Additionally, Nvidia’s CEO, when questioned about potential tariffs, affirmed the company’s commitment to comply with regulatory requirements under any administration.

Nvidia’s near-tripling share price in 2024 reflects investor confidence in its AI leadership. However, as growth rates normalize and the market matures, Nvidia’s ability to sustain momentum will be closely watched.

Featured image courtesy of Benzinga

Follow us for more tech news updates.