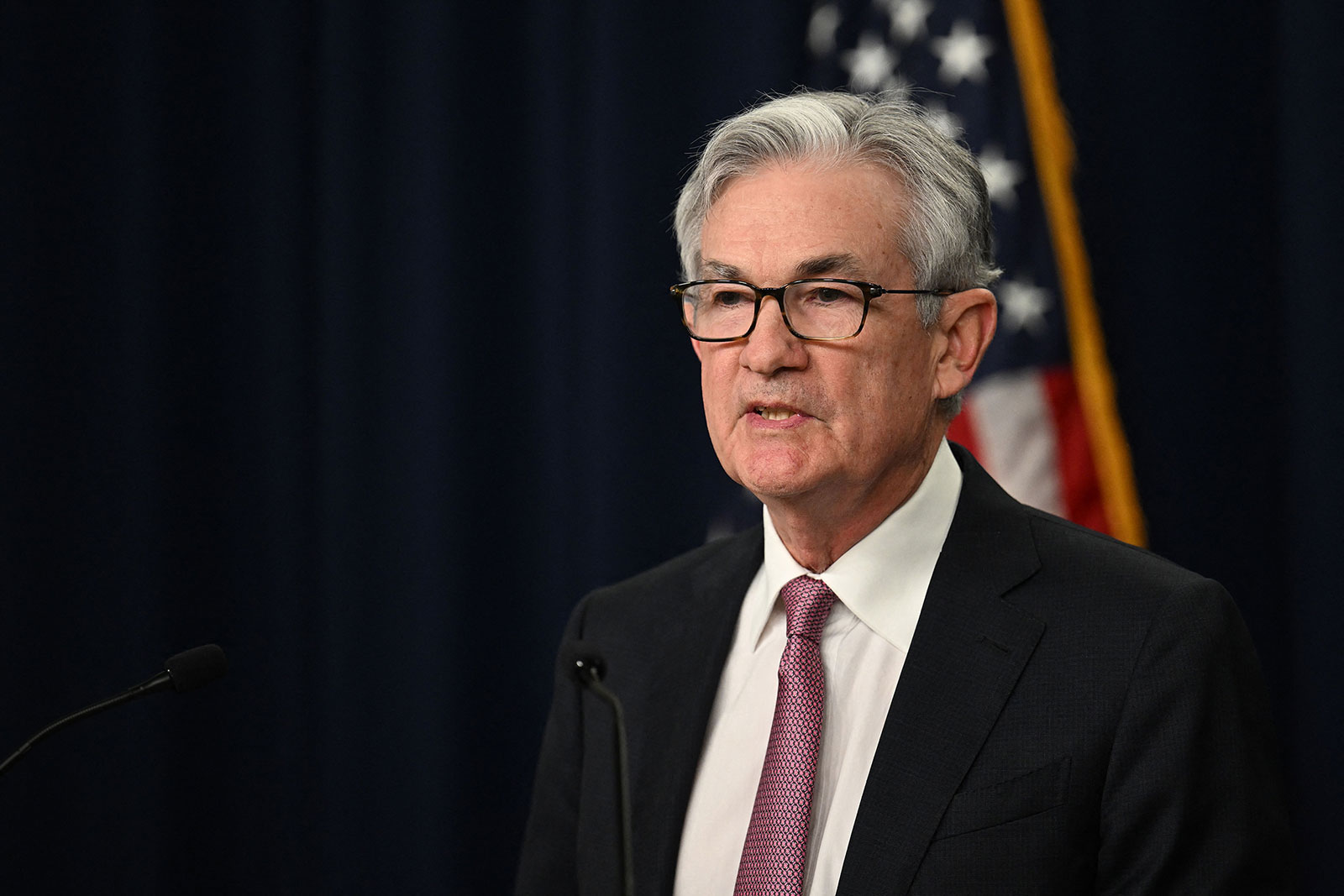

On February 1st, the Federal Reserve maintained its interest rates unchanged for the fourth consecutive meeting, indicating a potential openness to rate cuts in the future. However, Jerome Powell, the Fed Chair, tempered expectations for an imminent reduction in rates, notably in March.

Steady Rates Amid Inflation Observations

The Federal Open Market Committee (FOMC) underscored its cautious stance towards lowering interest rates. In a statement, the FOMC mentioned, “It does not anticipate reducing the target range until it has greater confidence that inflation is moving sustainably toward 2%.” Powell added weight to this cautious approach, expressing doubts about reaching a sufficient level of confidence by the March meeting.

Despite recognizing significant progress in inflation reduction, Powell highlighted the importance of additional data to confirm this downward trend. This came after the Fed’s two-day meeting which concluded with a more neutral outlook on future policy directions, moving away from previous suggestions of possible rate hikes.

Policy Rate and Economic Outlook

Powell suggested that the policy rate might have reached its peak for the current tightening cycle, assuming the economy evolves as expected. “We are prepared to maintain the current target range for the federal funds rate for longer, if appropriate,” he remarked, indicating a unanimous decision to keep the benchmark federal funds rate at a 22-year high of 5.25% to 5.5%.

The central bank also continues its strategy to reduce its balance sheet, committing to a reduction pace of up to $95 billion per month. Discussions on the balance sheet adjustments are set to deepen in the upcoming March meeting.

Following the meeting, adjustments in US Treasury yields were noted, and the S&P 500 index experienced a downturn. The likelihood of a March rate cut saw a reduction among investors.

Economic Activity and Banking System

The FOMC’s latest statement reflects an optimistic view of the economy, describing it as “expanding at a solid pace,” a nod to the stronger-than-anticipated economic growth in the last quarter. Additionally, previous remarks on the banking system’s resilience and the potential economic impact of tighter credit conditions were omitted.

The January meeting introduced new FOMC voters, including the presidents of the Federal Reserve’s regional banks in Atlanta, Cleveland, Richmond, and San Francisco. This rotation is part of the annual changes within the committee.

Inflation and Labor Market Performance

The economy outperformed Fed’s expectations last year, with notable declines in inflation, a GDP growth of 2.5%, and a robust job market maintaining the unemployment rate at around 3.7%. Upcoming job market data for January, anticipated to show solid performance, will be crucial for future economic assessments.

In the lead-up to the meeting, Fed policymakers expressed a willingness to consider rate cuts, albeit cautioning against rapid and significant reductions. The median forecast in December predicted a total of 75 basis points in cuts for the year, with updates expected in March.

Navigating Inflation Without Triggering Recession

The Federal Reserve is attempting a delicate balance: controlling inflation through tighter credit without plunging the U.S. into a recession, a feat it has rarely achieved. This effort unfolds against the backdrop of a presidential election year, adding to the challenge.

Recent communications from Democratic lawmakers, including Senate Banking Committee chair Sherrod Brown and Senator Elizabeth Warren, have urged Powell to lower interest rates to support economic growth.

Featured image credit: AFP via Getty Images