Nvidia continues to ride the AI boom, even as geopolitical issues with China and shifting US policies create uncertainty for the chipmaker.

The company announced $46.7 billion in revenue for the second quarter of the year, a 56% increase from the same period in 2024. Despite the strong numbers, Nvidia’s stock slipped in after-hours trading, as executives acknowledged ongoing challenges tied to international trade restrictions.

AI Demand Drives Growth

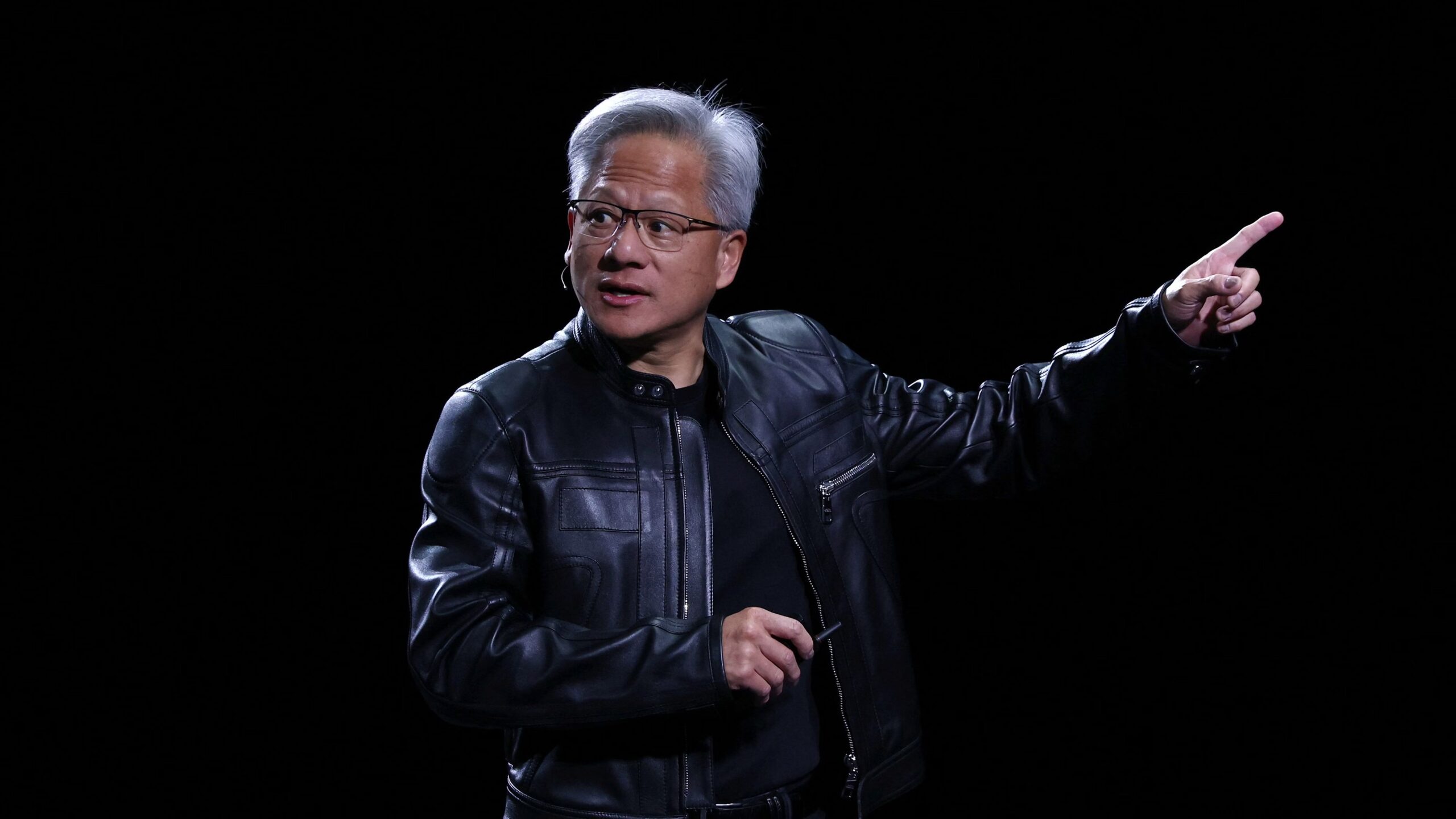

Nvidia’s advanced chips remain central to the AI revolution. On Wednesday, CEO Jensen Huang said demand is especially strong from major tech firms such as Meta and OpenAI, which have doubled their AI-related spending to $600 billion annually.

“The AI race is now on,” Huang told analysts, adding that artificial intelligence could ultimately accelerate global GDP growth, with Nvidia providing much of the required infrastructure.

Revenue from Nvidia’s data center business climbed 56% to $41.1 billion, though it came in slightly below Wall Street expectations. Analysts noted the “wobble” in share prices reflected the miss but emphasized that overall growth has been “unbelievable.”

Geopolitical Challenges

Nvidia remains under pressure from trade restrictions. The Trump administration’s shifting policies have forced the company to navigate tight rules on high-end chip sales to China.

In July, Nvidia resumed limited sales of its H20 chips to Chinese customers after lobbying successfully for a partial reversal of the ban. However, the US government began reviewing licenses again later in the month, and Nvidia has yet to ship any H20 units despite some approvals being granted. The administration also expects to collect 15% of revenues generated from licensed H20 sales.

Nvidia left H20 chips out of its current quarter guidance and is lobbying for permission to sell its Blackwell chips in China, the world’s largest chip market. Meanwhile, analysts warn that US restrictions are helping China accelerate its own domestic chipmaking efforts.

Nvidia has grown into a $4 trillion company, making it the most valuable in the world by market capitalization. The company projects revenue of $54 billion next quarter, ahead of analyst expectations, but its exposure to geopolitical risks remains a critical factor for investors.

Analyst Jacob Bourne noted that while Nvidia’s dominance is secure for now, “US export restrictions are fuelling domestic chipmaking in China,” which could challenge the company’s long-term position.

What The Author Thinks

Nvidia is both the biggest winner and the most vulnerable player in the AI boom. Its chips power nearly every major AI initiative, but its dependence on global markets—especially China—puts it at constant risk. While its technology advantage is undeniable, relying on government approvals for sales creates a fragile foundation. If China succeeds in building competitive domestic alternatives, Nvidia’s dominance could erode far faster than expected.

Featured image credit: Heute

For more stories like it, click the +Follow button at the top of this page to follow us.