While the majority of Wall Street steers clear of Chinese equities amidst escalating geopolitical tensions and economic uncertainties, a segment of analysts is guiding their clients towards the burgeoning sector of local semiconductor companies. According to insights from prestigious firms like Barclays and Sanford C. Bernstein, there’s a growing consensus that companies such as Naura Technology Group Co. and Hygon Information Technology Co. are poised to reach prominence on par with industry giants like Applied Materials Inc. and Advanced Micro Devices Inc. in the foreseeable future.

Strategic Shifts Amid US Restrictions

The crux of this investment optimism is rooted in the belief that US restrictions on access to advanced semiconductor technologies will inadvertently catalyze the growth of China’s domestic chip industry. This is seen not just as an industrial challenge but as a critical pivot for survival, potentially unlocking substantial opportunities for local enterprises. “This is an industry brimming with investment prospects for those who can discern the market’s eventual victors,” remarked Sun Jianbo, the president of China Vision Capital. The anticipated infusion of resources into this sector is expected to cultivate a fertile ground for the emergence of formidable home-grown entities.

Overcoming Obstacles

The journey towards such an outcome is daunting, especially considering the staggering $6.5 trillion loss in market value experienced by Chinese and Hong Kong stocks since February 2021. This downturn reflects the broader anxieties surrounding China’s sluggish economic performance and intensifying geopolitical frictions. Compounding these challenges are concerted efforts by the US and its allies to impose stringent export controls on cutting-edge chips and the critical equipment required for their production, targeting key Chinese corporations like Huawei Technologies Co. and Semiconductor Manufacturing International Corp.

China’s Countermeasures and Bernstein’s Picks

In response, China has committed over $100 billion towards cultivating a robust domestic supply chain capable of mitigating these constraints. Bernstein analysts, led by Qingyuan Lin, underscore Naura’s potential to mirror Applied Materials Inc.’s success, given its comprehensive portfolio of semiconductor manufacturing equipment. “The US sanctions, while potentially hindering China’s advancement in top-tier technology segments, also drive the country’s pursuit of self-reliance and success in areas ripe for domestic substitution,” Lin observed.

Hygon, despite losing access to AMD’s server chip technology due to US sanctions, has made significant strides in developing proprietary products. Bernstein anticipates that Hygon will benefit from the ongoing shift towards locally produced chips within Chinese data centers.

Financial Outlook and Market Performance

Projections suggest Naura’s sales could surge by a third in 2024, starkly contrasting with Applied Materials’ expected modest 1% revenue growth. Over the past year, Hygon’s shares have appreciated by 36%, mirroring the Nasdaq 100 Index’s 40% increase but lagging behind AMD’s impressive 110% surge. Meanwhile, Naura experienced a slight 2% decline during the same period.

The Road to Semiconductor Self-Sufficiency

China’s ambitious goal to achieve 70% self-sufficiency in semiconductor consumption by 2025 faces significant hurdles, with analysts from Barclays describing the nation’s progress as the beginning of a lengthy journey. Despite the challenges, the strategic and financial commitment from the Chinese government to bolster local production is anticipated to double output within five to seven years, marking a pivotal shift in the global semiconductor landscape.

The narrative unfolding around Chinese semiconductor companies is one of resilience, strategic redirection, and long-term potential. Wall Street’s select optimism amidst widespread caution reflects a nuanced understanding of the geopolitical and economic forces shaping the future of global semiconductor production. As the industry navigates through a period of unprecedented challenges and opportunities, the rise of Chinese semiconductor firms could redefine market dynamics and investment strategies in the years ahead.

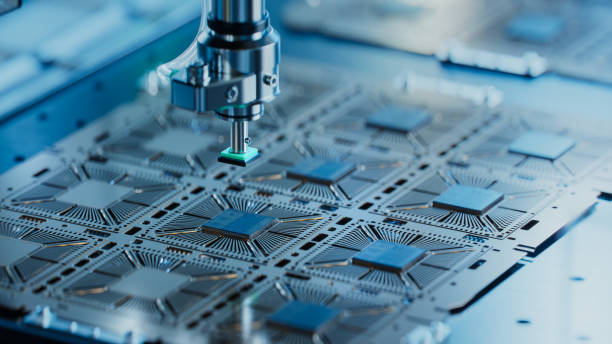

Featured image credit: SweetBunFactory via iStock