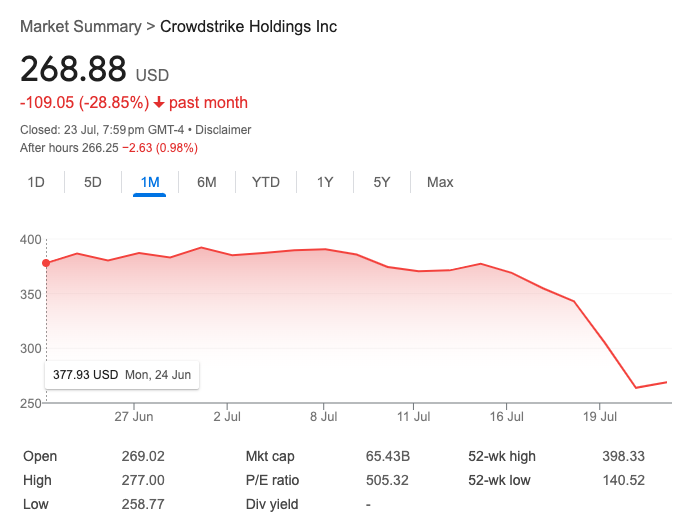

CrowdStrike Holdings Inc. experienced a significant decrease in share price, falling 13% on Monday. This decline followed a catastrophic global computer outage initiated by a problematic software update on July 19. Over the month, the American cybersecurity firm saw a total decrease in share value of 30%, with 23% of that loss occurring since the IT mishap.

Impact of the Software Failure

The failed update on July 19 led to one of the worst downturns in the company’s stock history. As shares plummeted to $263 in after-hours trading, they reached their lowest point since the beginning of the year. This downturn is a stark contrast to the all-time high of $392 recorded on July 1, according to Google Finance. Consequently, short sellers gained approximately $978 million from the company’s 23% two-day stock price decline, as reported by Bloomberg.

In the wake of this incident, analysts have reassessed CrowdStrike’s market position. Notably, Guggenheim analysts, led by John DiFucci, retracted their $424 price target for CRWD. Despite the immediate financial impact, DiFucci notes that “the company will eventually become even stronger as a result of this incident.” However, they communicated that it’s currently challenging to recommend purchasing CRWD stocks.

Cybersecurity Sector Trends

The cybersecurity software sector has witnessed nearly $12 billion in increased short interest this year alone. Within this sector, CrowdStrike stands as the second-most shorted company, trailing only behind Microsoft. The industry faces heightened scrutiny as analysts and investors adjust their expectations and price targets in response to the recent upheavals.

Jimmy Su, Chief Security Officer at Binance, indicated that similar incidents might occur due to the centralized nature of computing infrastructures. He warned that as long as the majority of global computer systems depend on this centralized model, the risk of significant outages remains.

Blockchain Resilience Amidst the Outage

Contrasting with the disruption faced by traditional sectors like banking and healthcare, decentralized crypto networks like Bitcoin remained unaffected. According to Su, the distributed architecture of blockchain technology ensures operational continuity even if a portion of the nodes fails. The Bitcoin network, for example, has operated without interruption for over 11 years.

Despite the recent setbacks, many Wall Street analysts maintain a long-term bullish outlook on CrowdStrike. The average price target from these analysts suggests a potential 40% upside from the current levels, indicating confidence in the company’s recovery and future growth.

| Date | Event | Stock Price (Close) | Impact on Share Value (%) |

|---|---|---|---|

| July 1 | All-Time High | $392 | – |

| July 19 | Software Update Failure | Decline Begins | -23% since the event |

| July 22 | Further Decline | $263 | -13% on the day |

| July 22 | Bloomberg Report on Short Sellers | $978 million Profit | – |

The resilience shown by CrowdStrike in the face of this significant adversity highlights the complexities and challenges within the cybersecurity industry. As the company navigates through these turbulent times, the broader market’s response will be crucial in shaping its path forward.

Featured image credit: Freepik

Follow us for more breaking news on DMR