Recent earnings reports reveal that not all semiconductor companies are reaping the benefits of the AI boom, highlighting the complexities of the semiconductor supply chain and the varying dominance of companies within different parts of the sector.

A range of semiconductor companies reported their financial results for the June quarter, showing mixed outcomes. Some exceeded market expectations, while others fell short. This disparity provides insight into how AI excitement impacts their earnings.

Current AI interest focuses on large language models (LLMs) and generative AI. LLMs, which require extensive computing resources and data, are foundational to generative AI applications like chatbots from Google and OpenAI. Tech giants investing heavily in training these models are not reducing their expenditures. Meta anticipates significant growth in capital expenditure in 2025 to support AI research and product development. Microsoft reported an 80% year-on-year increase in capital expenditure, reaching $19 billion in the June quarter.

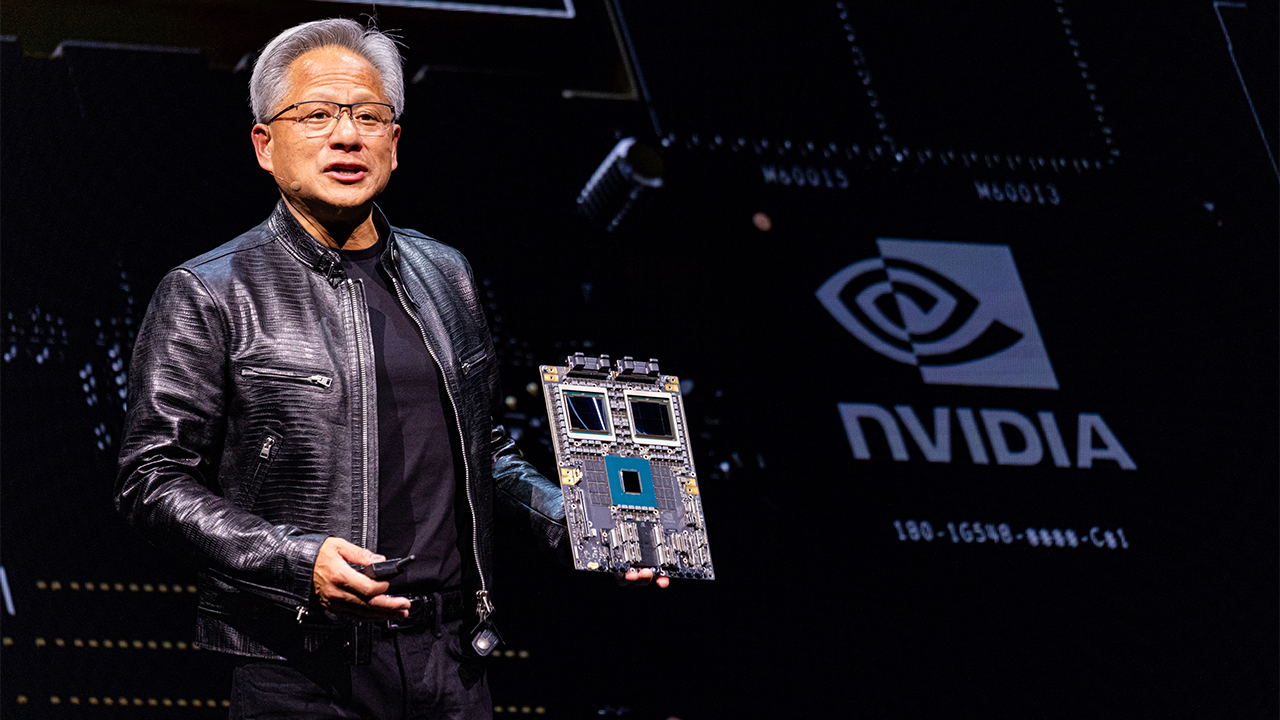

Nvidia has greatly benefited from this spending surge, as its graphics processing units (GPUs) are crucial for training LLMs. However, rival AMD has introduced the MI300X AI chip and is starting to see rewards. AMD expects its data center GPU revenue to surpass $4.5 billion in 2024, up from the $4 billion forecast in April. The company’s second-quarter earnings and revenue exceeded market expectations.

Chip manufacturing and tool companies are also benefitting from the AI boom. TSMC, the world’s largest semiconductor manufacturer, reported a 36% year-on-year rise in second-quarter net profit, surpassing market expectations. ASML, which produces tools for advanced chip manufacturing, saw a 24% year-on-year increase in second-quarter net bookings. Samsung’s second-quarter operating profit surged 1,458.2% year-on-year.

Despite the AI investment surge, not all semiconductor firms have experienced growth due to their limited exposure to the technology. Qualcomm and Arm saw their share prices fall after issuing light guidance for the current quarter. Although both companies emphasize their AI applications, their actual exposure remains minimal. Arm designs chip blueprints used in most smartphones, but this has not resulted in significant growth. Analysts suggest that Arm could benefit from AI as more devices incorporate the technology.

Qualcomm’s chips are primarily used in smartphones, such as those from Samsung, and the company still derives substantial revenue from handsets. Similar to Arm, Qualcomm’s silicon is not utilized in data centers where LLM training occurs. Although Qualcomm’s chips will feature in Microsoft’s upcoming AI PCs, this represents a longer-term opportunity.

Featured Image courtesy of Fox Business

Follow us for more updates on Nvidia.