Michael Saylor, the executive chairman of MicroStrategy, has recently come under fire for his remarks suggesting that Bitcoin custodianship is better managed by “too big to fail” financial institutions rather than through individual self-custody—a stance that starkly contrasts his earlier advocacy for self-custody. In an interview with Madison Reidy on October 21, Saylor’s comments sparked a wave of criticism from the Bitcoin community, questioning his shift in perspective.

Historically, Saylor has been a vocal proponent of Bitcoin and self-custody, often highlighting its significance in maintaining a decentralized network and protecting against potential abuses of power by large custodians. His recent endorsement of institutional custodianship over personal hardware wallets marks a significant reversal, which he defended by downplaying the risks of government interference in Bitcoin holdings, labeling concerns over potential state-sanctioned seizures of Bitcoin as myths propagated by “paranoid crypto-anarchists.”

Community Reaction to Saylor’s Remarks

The Bitcoin community responded swiftly and sharply. Figures like Simon Dixon, author and Bitcoin advocate, suggested that Saylor’s new stance might be influenced by MicroStrategy’s business ambitions to transform into a Bitcoin bank and provide collateralized loans, which would benefit from institutional custodianship. John Carvalho, CEO of Bitcoin payments firm Synonym, and other prominent Bitcoiners expressed disappointment, accusing Saylor of attempting to transform Bitcoin into merely an investment rather than a functional currency.

Supporters of Saylor’s latest views argue that his recommendations are pragmatically aimed at larger institutions that cannot practically engage in self-custody due to their operational scale. Julian Figueroa, founder and host of “Get Based,” noted that while small businesses and individual enthusiasts might prefer hardware wallets for sovereignty, large entities like pensions and wealth funds require the services of bitcoin banks to manage their Bitcoin assets effectively.

MicroStrategy’s Position in the Bitcoin Market

MicroStrategy, under Saylor’s leadership, holds an extensive portfolio of Bitcoin, making it the largest corporate holder with over 252,220 BTC. Saylor’s bullish outlook on Bitcoin remains strong, with predictions of its value reaching $13 million per coin by 2045, reflecting his confidence in Bitcoin’s long-term value proposition despite his controversial views on custodianship.

Reflecting on Saylor’s historical stance, he has consistently emphasized the importance of self-custody in protecting the integrity of the Bitcoin network. His previous statements highlight the dangers of centralized control, advocating for self-custody as essential to preserving the decentralized ethos of Bitcoin. This historical context makes his current endorsement of institutional custody all the more puzzling and controversial among crypto enthusiasts.

Michael Saylor’s recent endorsement of “too big to fail” banks for Bitcoin custodianship has ignited a debate within the cryptocurrency community about the future of Bitcoin custodianship. While some see his position as a pragmatic shift towards institutional adaptation, others view it as a betrayal of the foundational principles of cryptocurrency. As the discussion unfolds, the implications of this shift for MicroStrategy and the broader crypto landscape remain a key point of contention.

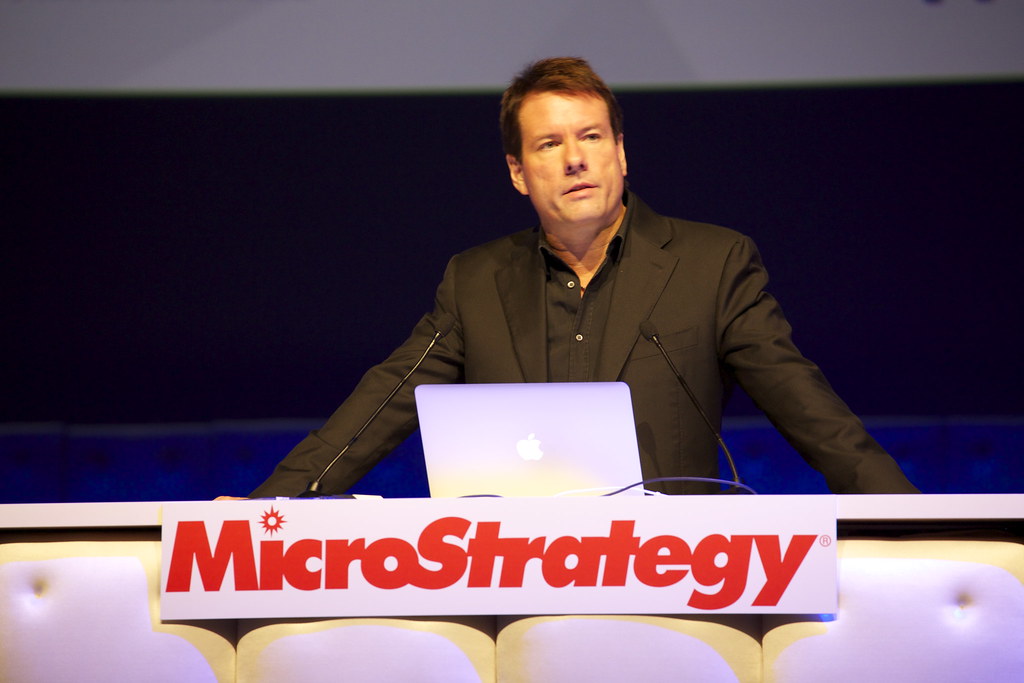

Featured image credit: MicroStrategy via Flickr

Follow us for more breaking news on DMR