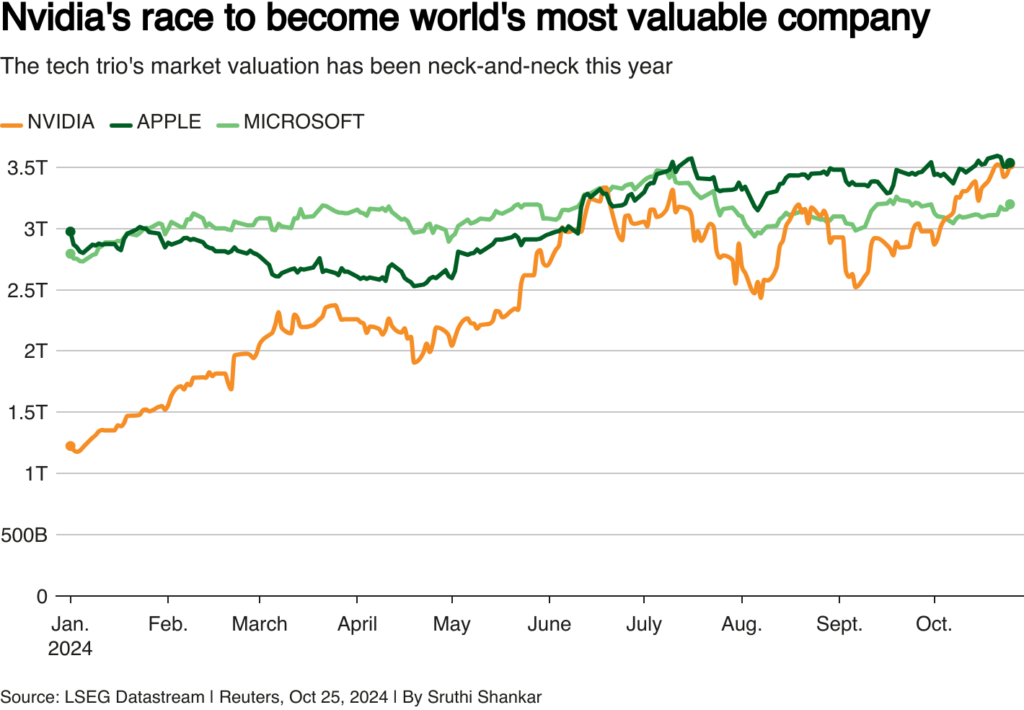

Nvidia has claimed the title of the world’s most valuable company, temporarily surpassing Apple on Friday after a historic stock rally driven by extraordinary demand for its artificial intelligence (AI) chips. Nvidia’s market value briefly hit $3.53 trillion, slightly above Apple’s $3.52 trillion, according to LSEG data. By the day’s end, Nvidia closed up 0.8%, with a market cap of $3.47 trillion, while Apple’s stock rose 0.4%, valuing the iPhone giant at $3.52 trillion.

This is not the first time Nvidia has briefly led the market; in June, it became the world’s most valuable company before being overtaken by Microsoft and Apple. Microsoft currently holds a market value of $3.18 trillion, reflecting a 0.8% gain in its stock. As a leading supplier of AI processors, Nvidia has emerged as a key player among tech giants, including Microsoft, Alphabet, and Meta Platforms, vying to dominate AI technology.

Historically recognized for its gaming processors, Nvidia’s stock has climbed approximately 18% in October, driven by OpenAI’s recent $6.6 billion funding round announcement. Shares in Nvidia and other semiconductor firms were buoyed Friday after Western Digital surpassed quarterly profit expectations, sparking optimism about data center demand.

Investment analysts, including Russ Mould of AJ Bell, underscore Nvidia’s advantageous position in the market, with AI adoption steadily rising among businesses. “More companies are now embracing artificial intelligence in their everyday tasks, and demand remains strong for Nvidia chips,” Mould commented. Despite potential risks from a U.S. economic downturn, Nvidia’s chips are seen as a crucial asset for companies aiming to scale AI capabilities.

Nvidia’s upward trajectory continued Tuesday, reaching record highs after Taiwan Semiconductor Manufacturing Company (TSMC) reported a 54% surge in quarterly profits, driven by heightened AI chip demand. Meanwhile, Apple has encountered softer demand for its smartphones, with iPhone sales in China falling by 0.3% in Q3, while Huawei saw a 42% spike in sales. Apple is expected to report its quarterly earnings Thursday, with analysts projecting a 5.55% year-over-year revenue increase to $94.5 billion, compared to Nvidia’s anticipated 82% revenue growth to $32.9 billion.

The significant influence of Nvidia, Apple, and Microsoft within the technology sector and the broader U.S. stock market is underscored by their collective weight, representing nearly a fifth of the S&P 500 index. The ongoing AI boom, coupled with expectations for a reduction in U.S. interest rates and a strong start to earnings season, recently pushed the S&P 500 to a record high. Nvidia’s exceptional stock performance has also attracted substantial interest from options traders, with its options becoming some of the most traded in recent months, according to Trade Alert.

Nvidia’s stock has risen nearly 190% this year, fueled by surging interest in generative AI, which has propelled its forecasts to impressive levels. “The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone,” remarked Rick Meckler, partner at Cherry Lane Investments. He added that Nvidia’s near-term figures are likely to be “quite remarkable.”

Featured image courtesy of ddnews.gov.in

Follow us for more tech news updates.