Taiwan’s legacy chip industry is at a crossroads as Chinese foundries rapidly expand their market share by offering steep price cuts and increasing production capacity. Powerchip Technology’s early move into China in 2015, once seen as a strategic advantage, has now turned into direct competition, with its former venture, Nexchip, emerging as a major rival. Taiwanese chipmakers, including UMC and Vanguard International, are being pushed to shift strategies, moving toward specialized and advanced manufacturing processes to stay competitive.

China’s push into mature node chip manufacturing—covering 28nm technology and larger—has drawn concern from U.S. regulators. The Biden administration recently launched an investigation into the sector, as China’s rise in the $56.3 billion industry threatens the long-held dominance of Taiwanese companies. Supported by strong government funding, Chinese foundries like Nexchip, Hua Hong, and SMIC have adopted aggressive pricing strategies, challenging Taiwan’s established players in automotive and display panel chip production.

Taiwan’s Foundries Pivot to Survive

Taiwanese chipmakers are feeling the squeeze as Chinese competitors flood the market with cheaper alternatives. Frank Huang, chairman of Powerchip Investment Holding, acknowledged the challenges, stating that mature-node foundries must evolve or risk severe losses. Powerchip’s restructuring in 2019 into Powerchip Manufacturing Semiconductor Corporation reflects its attempt to navigate the shifting landscape. Meanwhile, UMC is partnering with Intel to develop smaller, more advanced chips to move beyond legacy chipmaking.

Trade tensions between the U.S. and China may offer some relief. American companies looking to secure alternative supply chains have increased their demand for Taiwan-made chips. However, former U.S. President Donald Trump has indicated he may introduce tariffs of up to 100% on semiconductors manufactured outside the United States, which could further reshape the global supply chain.

China’s Market Share Growth Accelerates

Blocked from advancing in high-end chip technology due to U.S. restrictions, China has turned its focus to mature-node chips. With government-backed financial support and a willingness to accept lower margins, Chinese foundries have significantly increased their production capacity. TrendForce data from 2024 shows that China now controls 34% of the global mature node manufacturing capacity, up from previous years, while Taiwan holds 43%. By 2027, China is expected to overtake Taiwan in this segment, while South Korea and the U.S. are projected to see declines.

Industry experts point to China’s rapid expansion in chip fabrication as a key factor in its rising dominance. Consultancy SEMI estimates that out of 97 new fabrication plants coming online between 2023 and 2025, 57 will be in China. These numbers illustrate the scale at which China is ramping up production.

Localization Push and Changing Customer Demands

Taiwanese chip executives note that since 2023, Chinese foundries have become more aggressive in pitching business, particularly in consumer-focused industries like display panels. Beijing’s localization push has also led to increased demand for domestic chip production, with Chinese clients favoring local fabs over Taiwanese suppliers. Two executives from Taiwan-based chip design firms confirmed that Chinese companies, including government-affiliated firms like China Mobile and China Telecom, have set stricter requirements on sourcing China-made components.

Powerchip’s Huang acknowledged the impact, stating that the company plans to scale back its production of display driver and sensor chips—products heavily used in the Chinese market—in favor of advanced manufacturing techniques such as 3D stacking. This shift would integrate logic and DRAM memory chips to improve computing performance and efficiency. Despite still holding a 19% stake in Nexchip, Powerchip no longer has an active management role in the company.

U.S. Restrictions May Offer Taiwan Some Relief

Geopolitical factors may play a role in shaping Taiwan’s chip industry future. As Washington continues its efforts to curb China’s semiconductor ambitions, companies outside China are looking to diversify supply chains. Taiwanese chip designers have reported increased orders from international customers who explicitly request that their chips not be manufactured in China.

An executive at a Taiwan-based chip design company shared that since 2023, more clients have insisted on avoiding China-based production altogether. “Some customers will tell us that no matter what, they don’t want us to tape out chips in China; they don’t want ‘Made in China,’” the executive said.

Taiwanese foundries still hold advantages in process stability and production yield rates. However, they will need to continue adapting to remain competitive as China’s presence in the legacy chip market grows. Whether through specialization, technology advancements, or supply chain diversification, Taiwan’s chip industry faces a critical moment in determining its future direction.

Authors Opinion

Taiwan’s legacy chip industry stands at a pivotal moment, caught between China’s aggressive expansion and shifting global trade dynamics. While Taiwanese foundries have long been known for their production stability and efficiency, price competition from Chinese rivals—backed by government subsidies and lower-margin strategies—has made the market increasingly difficult to navigate. The industry’s future will likely depend on specialization, technological advancements, and supply chain diversification, but the question remains whether these efforts will be enough to offset China’s rapid rise. With geopolitical tensions influencing global semiconductor decisions, Taiwan may find itself both challenged and unexpectedly aided by shifting alliances and trade policies.

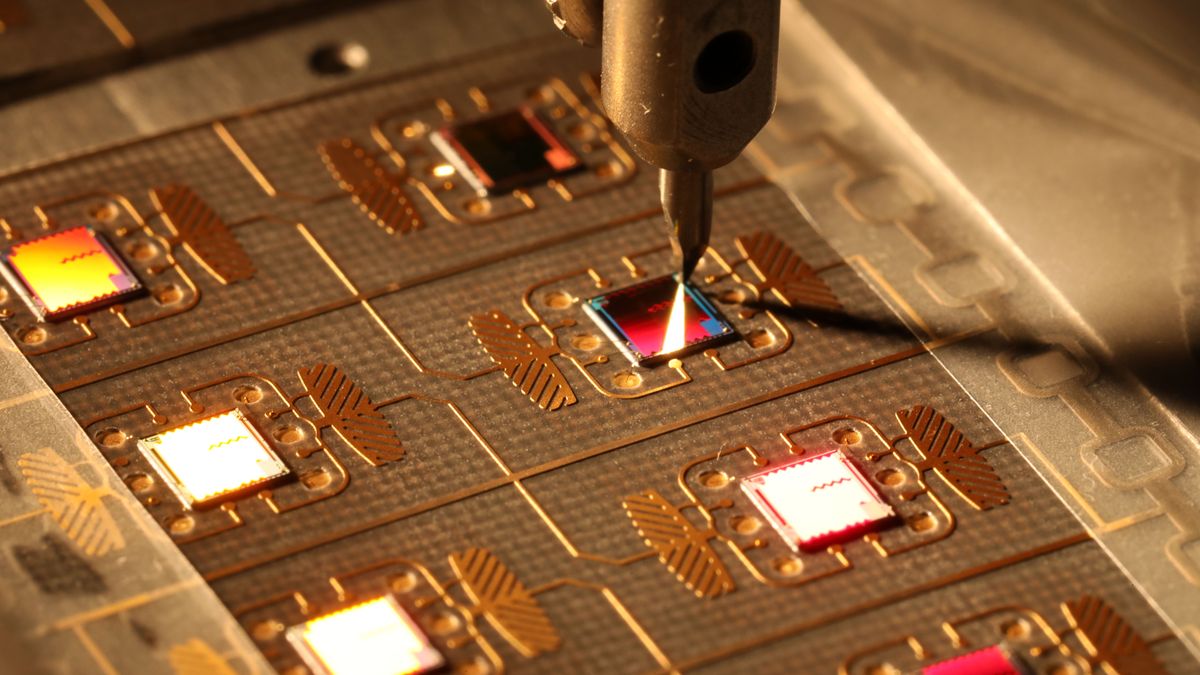

Featured image courtesy of PC Gamer

Follow us for more tech news updates.