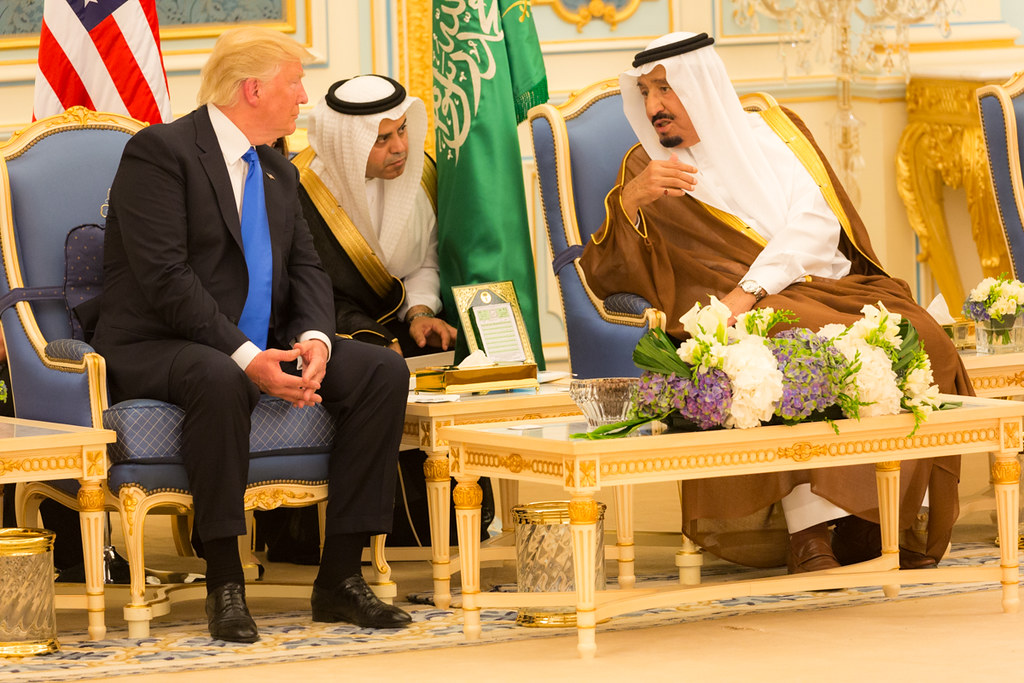

Saudi Arabia’s Crown Prince Mohammed bin Salman is set to meet U.S. President Donald Trump on Tuesday. Their aim is to increase trade and investment prospects between the two countries. Now Saudi Arabia is capitalizing on their sovereign wealth fund, the Public Investment Fund (PIF), which has a staggering $925 billion portfolio. The small nation wants to get closer economically to their big neighbor to the north, the United States.

Strategic Importance of the Upcoming Meeting

The upcoming meeting could not be more important for Saudi Arabia at this moment. The nation is determined to lessen its economic reliance on oil and striving to do just that. The kingdom has poured billions into the US. It’s looking that Trump’s visit will spark the imaginations of American businesses to pursue new frontiers, particularly in artificial intelligence, healthcare and education. Crown Prince Mohammed—MBS for short—has more ambitious designs in mind. This is no accident; he wants Saudi Arabia to invest $600 billion in the U.S. in the next few years.

Saudi Arabia is making aggressive, concerted efforts to establish itself as a worldwide AI center. They are working together through a joint initiative to lure foreign investment into their growing tech hub. The kingdom’s government has invested billions of dollars into technology and AI specifically. Because they know that innovation is key to their Vision 2030 program, which seeks to diversify their economy through rapid growth and innovation.

Construction and investing in public infrastructure are priorities of Saudi Arabia. This move takes on particular importance as the country seeks to build an enduring economic structure independent of oil wealth. The next Saudi-U.S. investment forum will take place on May 13 in Riyadh. It will showcase this commitment by bringing together leading CEOs from some of the nation’s largest firms including BlackRock, Palantir, Citigroup, IBM, Qualcomm, Alphabet and Franklin Templeton.

During this pivotal meeting, Saudi Arabia will seek assurances from the White House regarding the implementation of a “more efficient procurement system.” Such a system would make it far easier and faster for Saudi Arabia to obtain ammunition and military equipment. Right now, Saudi Arabia is poised to pull off the biggest one. They’re obliged to pledge to buy more than $100 billion U.S. arms and military items.

The U.S. needs more than a tweet’s worth of commitment, though the kind that President Trump is apparently hoping for from the Gulf, said Karen Young, an expert on Middle Eastern economies. This feeling parallels the administration’s aspiration to show off major investments during this diplomatic visit.

Positive Momentum for U.S.-Saudi Economic Integration

Given all these assumptions and caveats, here’s why analysts believe the Trump administration is moving in the right direction to encourage these investment deals. And the Trump administration is moving forward with procedures to make those deals easier and faster. Therefore, we would hope that this process would start to get better right from the start,” remarked Ali Shihabi, a commentator on U.S.-Saudi relations.

Shihabi went on to stress that these partnerships will help to connect the two economies at an even deeper level. “These deals will further integrate the Saudi and U.S. economies together: joint ventures in the kingdom, in the United States, procurements of American weapons and goods,” he stated.

In addition to this sense of opportunity, there seems to be an overall eagerness from Saudi companies to work with their American peers. “There is a very big appetite for Saudi companies to collaborate with American companies,” remarked Huthaim Al Jalal, highlighting the mutual interest in fostering economic cooperation.

Even with this rosy forecast, trouble may be lurking on the horizon. Foreign direct investment into Saudi Arabia has declined for a third consecutive year in 2024, raising concerns about the effectiveness of its investment strategies.

Author’s Opinion

Saudi Arabia’s push to diversify its economy beyond oil is ambitious and necessary, but the challenges are immense. While the investment commitments from the U.S. are a positive step, the decline in foreign direct investment over the past few years raises doubts about the effectiveness of their strategy. Saudi Arabia needs to accelerate its efforts to attract sustained foreign capital, particularly in high-growth sectors like AI and technology, to ensure that its Vision 2030 program becomes a success.

Featured image credit: Trump White House Archived via Flickr

For more stories like it, click the +Follow button at the top of this page to follow us.