With the Chinese stock market experiencing significant declines, anticipation is growing for a more decisive intervention from the government. Reports have surfaced that China’s top regulators, led by the China Securities Regulatory Commission (CSRC), are set to present a comprehensive briefing to President Xi Jinping as early as Tuesday. This move signals a potential shift towards more aggressive measures to curb the market downturn that has erased trillions in value from Hong Kong and Chinese equities since their 2021 peaks.

Market Rebounds Amid Speculation

Following these reports, the Chinese stock market witnessed a notable rebound, with the CSI 300 index recording its largest intraday gain since August and smaller-cap stocks also seeing substantial increases. This resurgence reflects traders’ optimism that the upcoming briefing might pave the way for new support strategies, diverging from previous piecemeal approaches that have failed to inspire confidence among investors.

The timing is crucial as China approaches the week-long Lunar New Year holiday, a period when maintaining market stability becomes even more paramount to safeguard consumer confidence. The speculation around the meeting and potential new measures underscores the delicate balance policymakers must strike between stabilizing the stock market and addressing broader economic challenges.

Recent Supportive Measures and Foreign Interest

Earlier in the day, entities such as Central Huijin Investment Ltd announced plans to bolster the market by purchasing more exchange-traded funds, reflecting a concerted effort to stabilize market operations. These announcements, coupled with a surge in foreign inflows, suggest a growing interest in Chinese equities, perhaps buoyed by expectations of governmental intervention.

However, investors remain cautious, mindful of the potential for disappointment should the meeting’s outcomes not meet expectations. The market’s volatility and the transient nature of previous stimulus-driven rallies highlight the complexity of achieving a sustained recovery amid economic headwinds and policy uncertainties.

State’s Increasing Involvement in Financial Policies

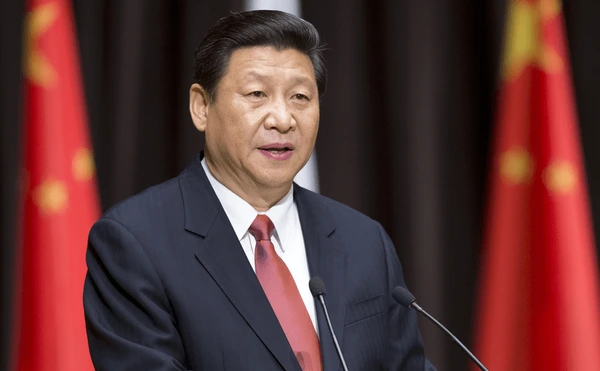

President Xi’s heightened involvement in financial and economic policies, evidenced by his rare visit to the central bank, reflects a proactive stance towards addressing market instability. Efforts by regulatory bodies to devise rescue strategies have intensified, with the securities regulator and the National Financial Regulatory Administration engaging in rigorous planning to stabilize capital markets.

In a bid to curb market losses, officials have recently implemented trading restrictions, targeting quantitative hedge funds and adjusting brokerage margin call levels. These measures aim to minimize forced selling and speculative trading, contributing to a broader strategy to support market valuations.

Investor Sentiment and Market Performance

Despite these interventions, investor confidence remains shaky, influenced by economic slowdowns, increased regulatory oversight, and geopolitical tensions. The market’s performance continues to lag behind global counterparts, underscoring the significant challenges facing Chinese equities.

The prospect of a high-level briefing to President Xi Jinping has ignited speculation that a turning point may be near, with coordinated actions possibly on the horizon to address the market slump. Investors and market analysts closely watch for official announcements and policy details, hoping for signs of a sustained recovery strategy that can restore confidence and drive a rebound in Chinese stocks.

Featured image credit: Kaliva via Shutterstock