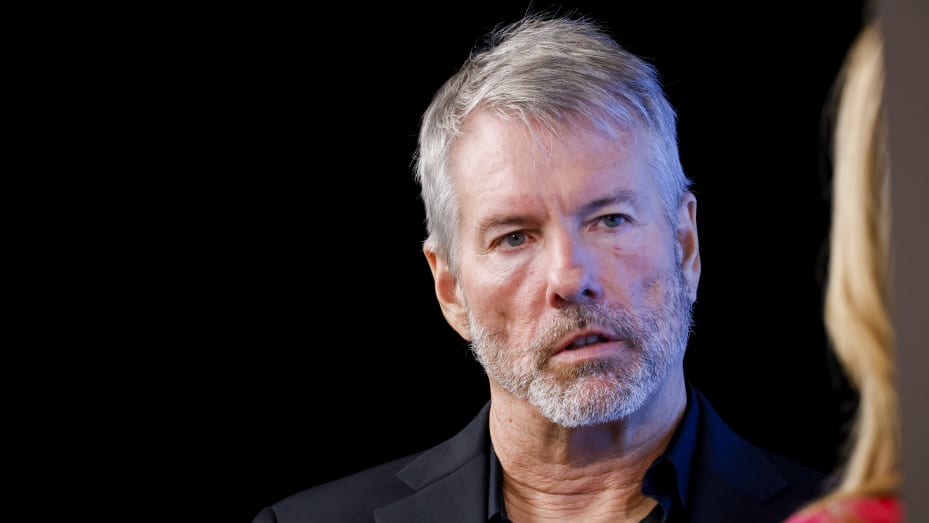

Michael Saylor, the visionary co-founder and executive chairman of MicroStrategy Inc., embarked on a significant investment journey in 2020 by acquiring large amounts of Bitcoin. This decision has proven exceptionally profitable for him and the company in recent times.

Financial Windfall from Strategic Stock Sales

From January through the previous week, Saylor has realized approximately $400 million from systematically selling about 5,000 shares daily. These sales were part of a strategy following the exercising of stock options awarded in 2014, set to expire soon. Remarkably, the value of MicroStrategy’s stock has doubled this year to about $1,290, even outperforming Bitcoin itself, which had also seen substantial gains during the same period. Back in 2014, MicroStrategy’s shares were trading at around $160.

Despite concerns that Saylor might be selling his shares at a peak market value, investor confidence remains strong. Lance Vitanza, a managing director at TD Cowen with a “buy” recommendation for MicroStrategy, noted that Saylor’s actions hadn’t significantly alarmed investors. He emphasized that Saylor still retains a significant portion of his stock holdings.

Premium Pricing and Market Speculation

The surge in MicroStrategy’s stock value over the actual price of Bitcoin, especially after the launch of US-based Bitcoin ETFs in January, has started to draw skepticism. Critics like Kerrisdale Capital Management have expressed doubts, opting to short the stock due to its rapid price increase. Austin Campbell, a Columbia Business School adjunct professor, questioned the logic of investing in MicroStrategy at a premium when direct Bitcoin ETFs are available, describing the stock as trading on “magical belief” rather than fundamentals.

MicroStrategy recently reported a first-quarter loss of $53 million, taking an impairment charge against its Bitcoin holdings, which contrasts with the cryptocurrency’s price increase during the quarter. Due to existing accounting rules, the company cannot acknowledge the rise in Bitcoin’s value, which surged by nearly 67% in the recent quarter. A new accounting rule set to be implemented by 2025 will adjust this, allowing digital assets to be valued at market prices, though MicroStrategy did not adopt this change for the first quarter.

Outlook and Strategy

MicroStrategy’s strategy under Saylor’s leadership remains straightforward: raise capital through equity or debt and invest the proceeds in Bitcoin. This approach aligns with the company’s broader strategy to hedge against inflation using Bitcoin as a primary asset. Jeff Dorman, CIO at Arca, highlighted that as Bitcoin’s value increases, so does MicroStrategy’s stock, allowing the company to further capitalize on this cycle.

Michael Saylor’s bold decision to integrate Bitcoin into MicroStrategy’s financial strategy continues to play a pivotal role in the company’s performance and market perception. While the approach carries risks, the potential rewards, as demonstrated by recent gains, underscore its potential efficacy. As the market evolves and new accounting rules come into play, MicroStrategy’s financial strategies and their outcomes will remain a focal point for investors and analysts alike.

Featured image credit: Rubaitul Azad via Unsplash