The Middle East and North Africa (MENA) region has emerged as a significant player in the global cryptocurrency landscape, accounting for 7.5% of the world’s cryptocurrency transaction volume from July 2023 to June 2024, according to a recent report by Chainalysis. This period saw the region processing an estimated $338.7 billion in transactions, highlighting its growing influence in the digital asset market.

Institutional Dominance in the MENA Crypto Market

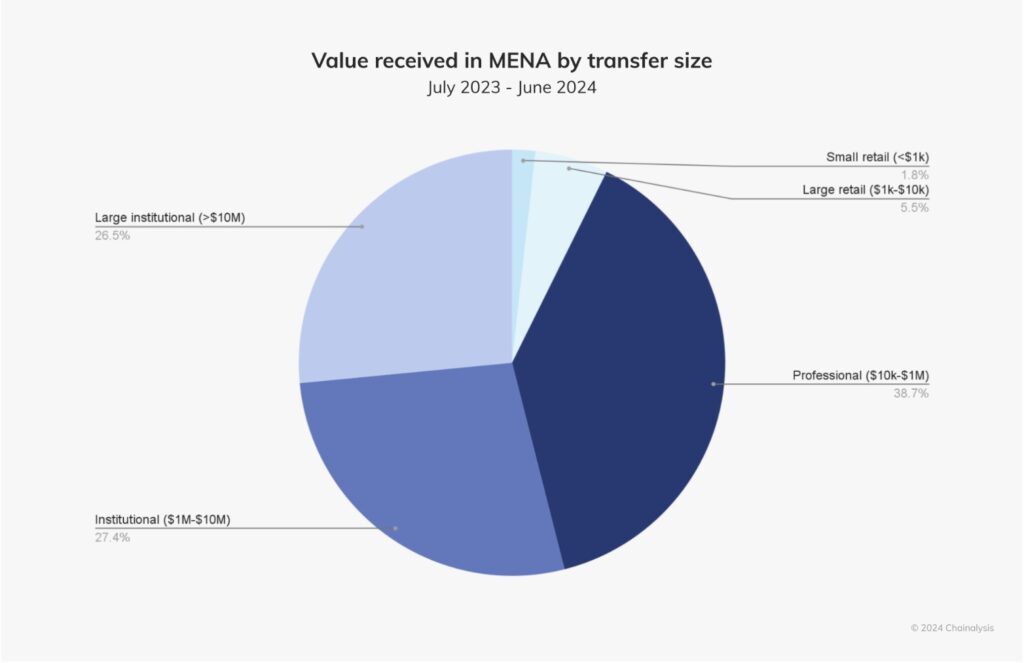

The Chainalysis report points out that the bulk of the cryptocurrency transactions in the MENA region were dominated by institutional and professional investors. A staggering 93% of these transactions were valued at $10,000 or more, indicating a market driven largely by high-stake investors rather than small retail participants, who accounted for only 1.8% of the total transaction volume.

While centralized exchanges were the primary conduits for onchain traffic in the MENA region, there was notable interest in decentralized platforms, especially in the United Arab Emirates (UAE) and Saudi Arabia. This interest aligns with a global trend of increasing adoption of decentralized finance (DeFi) solutions, which offer alternatives to traditional financial systems.

UAE’s Regulatory Advances and Global Crypto Hub Status

The UAE has particularly been recognized for its regulatory clarity and proactive stance on digital assets, which has helped establish it as a global hub for cryptocurrency. Several key developments have underscored this status:

- Dubai Court of First Instance Ruling: In August 2024, this court enhanced the legitimacy of cryptocurrencies by ruling that they are valid forms of payment in employment contracts. This landmark decision came after a plaintiff, who was to be paid partly in EcoWatt tokens along with fiat currency, did not receive the promised tokens and the court initially awarded monetary damages in 2023. The 2024 ruling revised this to specifically include cryptocurrency.

- Regulatory Integration: In September 2024, financial regulators in the UAE further integrated the cryptocurrency sector into the national economy by permitting Dubai-licensed virtual asset providers to operate across the entire country. This move was facilitated by a partnership between Dubai’s Virtual Assets Regulatory Authority (VARA) and the UAE’s Securities and Commodities Authority (SCA), streamlining the regulatory process and enhancing investor protection against risks and fraud.

- Custodial Insurance Approval: The Central Bank of the United Arab Emirates recently approved a custodial insurance product to safeguard financial institutions and their clients from potential losses due to hacks, internal fraud, and damages to storage infrastructure. This development is part of a broader effort to bolster the security and reliability of digital asset services.

The MENA region’s significant share of the global cryptocurrency transaction volume reflects its pivotal role in shaping the future of finance. The developments in regulatory frameworks, particularly in the UAE, not only provide a model for other nations but also promote a stable and secure environment for investors and participants in the digital economy.

As the MENA region continues to carve out a substantial niche in the global cryptocurrency market, its evolving regulatory landscape and the increasing integration of digital assets into its financial systems are likely to influence broader market dynamics and innovation in the digital asset space globally.

Featured image credit: DALL-E by ChatGPT

Follow us for more breaking news on DMR