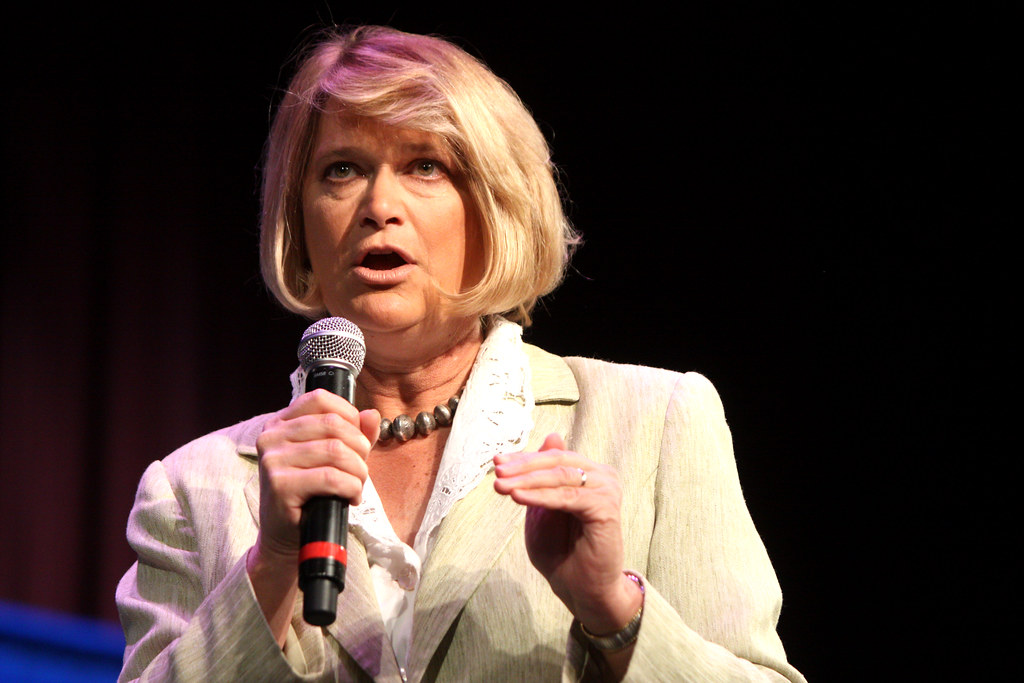

Wyoming Senator Cynthia Lummis is pushing for the United States Treasury Department to convert a portion of its gold holdings into Bitcoin in order to establish a Bitcoin strategic reserve. This proposal, which Lummis discussed in an interview with Bloomberg, is aimed at securing the nation’s financial future by diversifying its reserves with a digital asset that she believes will play a key role in the global economy.

Lummis explained that by converting the gold certificates held by the U.S. Treasury into Bitcoin, the immediate effect on the U.S. government’s balance sheet would remain “neutral,” unlike if the government were to spend approximately $90 billion to buy Bitcoin at its current market price. This approach, according to Lummis, would make it easier for the government to gain exposure to Bitcoin without having to use funds from other parts of the budget.

The Senator has long advocated for the U.S. to diversify its assets, and she has previously argued that a portion of the Treasury’s assets should be converted into Bitcoin. However, she has not specified which of the Treasury’s holdings should be sold to acquire the digital currency. Her strategic reserve proposal suggests that this allocation could be drawn from the U.S. government’s existing gold reserves.

Bitcoin Strategic Reserve: A National Priority?

The concept of a Bitcoin strategic reserve gained more traction when Senator Lummis introduced the Strategic Bitcoin Reserve bill to the Senate. The bill outlines a plan to acquire up to 5% of the total Bitcoin supply—approximately 1 million BTC—which would be held for 20 years. At current market prices, this would cost around $90 billion. For Lummis, the initiative is about ensuring the U.S. is positioned strategically as global interest in Bitcoin continues to rise.

Lummis justified the need for such a reserve by citing economic concerns, especially the ongoing struggles of families in her home state of Wyoming, where inflation rates have soared and the national debt continues to climb. “As families across Wyoming struggle to keep up with soaring inflation rates and our national debt reaches new and unprecedented heights,” Lummis remarked, “it is paramount that we establish a reserve in Bitcoin to safeguard our financial future.”

Her proposal, if passed, would mark a major shift in how the U.S. government approaches its financial reserves. It would also set a precedent for other countries looking to diversify their reserves with digital assets. While the idea has garnered attention from Bitcoin supporters, it has also sparked debates regarding the long-term viability and risks of such a strategy.

The proposed $90 billion price tag to acquire 1 million BTC might seem steep, but some believe it is a small price to pay in comparison to the national debt. Investor and asset manager Anthony Pompliano argued that, given the national debt’s rapid increase, spending $90 billion on Bitcoin could actually be a prudent investment. “The national debt increased by $850 billion in the last 90 days. If we were to try to put that same $850 billion into Bitcoin, that is about half of the current market cap. So, we’re talking about 50-100 billion dollars—small rounding errors when it comes to government spending. And I think that it is well worth the risk-reward.”

Pompliano’s view highlights the growing perception that Bitcoin is a store of value—potentially more stable and profitable in the long term than traditional assets like gold or government debt. However, critics of the idea argue that such a large purchase of Bitcoin could have unintended consequences, including exacerbating the volatility of the asset’s price. This concern is particularly relevant given Bitcoin’s notorious price swings and the potential risks associated with holding such a large amount of the asset.

The Role of a Bitcoin Strategic Reserve Under a Trump Administration

As discussions continue about the feasibility of establishing a Bitcoin reserve, some industry leaders, such as Galaxy Digital CEO Mike Novogratz, have expressed skepticism about whether such a reserve would materialize under a Trump administration. In a recent statement, Novogratz suggested that while the idea of a Bitcoin reserve is interesting, it may not come to fruition during Trump’s term.

However, Novogratz also noted that if the Bitcoin reserve were to be established under President-elect Donald Trump, the price of Bitcoin could skyrocket. Novogratz predicted that the announcement of a Bitcoin strategic reserve could push Bitcoin’s price to as high as $500,000 per BTC, citing the global demand for Bitcoin and the potential for governments to stockpile the asset.

The speculative nature of Bitcoin’s future price is one of the reasons why some remain cautious about adopting Bitcoin as a reserve asset. While the idea of a Bitcoin strategic reserve is intriguing, it would require careful management and a thorough understanding of Bitcoin’s market dynamics. Novogratz’s forecast suggests that if the reserve were to be implemented, it would have a significant impact on the cryptocurrency’s price, possibly accelerating its adoption as a store of value.

| Aspect | Details |

|---|---|

| Reserve Target | 5% of total Bitcoin supply (1 million BTC) |

| Holding Period | 20 years |

| Estimated Cost | $90 billion at current market prices |

| Justification | Diversify U.S. Treasury assets and safeguard financial future |

| Potential Impact on Bitcoin | Could push Bitcoin price to $500,000 per BTC (according to Novogratz) |

| Senate Bill | Introduced to establish a Bitcoin strategic reserve |

| Purpose | Protect U.S. from inflation and national debt growth |

The Long-Term Impact of a Bitcoin Strategic Reserve

Establishing a Bitcoin strategic reserve could be a transformative move for the U.S. government, but it comes with significant risks. The volatility of Bitcoin’s price means that such a move could have unintended consequences, both positive and negative. While the idea of diversifying U.S. reserves with an asset like Bitcoin is innovative, the government would need to carefully manage the risks associated with holding such a high-risk, high-reward asset.

If Bitcoin continues its upward trajectory, this strategy could yield substantial returns, strengthening the U.S. dollar and providing a hedge against inflation and national debt. However, the unpredictability of the cryptocurrency market presents a challenge that cannot be overlooked. Any significant downturn in Bitcoin’s price could potentially undermine the financial stability the reserve is meant to protect. Ultimately, adopting Bitcoin as part of the U.S. Treasury’s reserve strategy would require careful planning, a long-term commitment, and a solid understanding of the market dynamics involved. It’s a bold move, but one that could have far-reaching consequences for the global financial landscape.

Featured image credit: Gage Skidmore via Flickr

Follow us for more breaking news on DMR