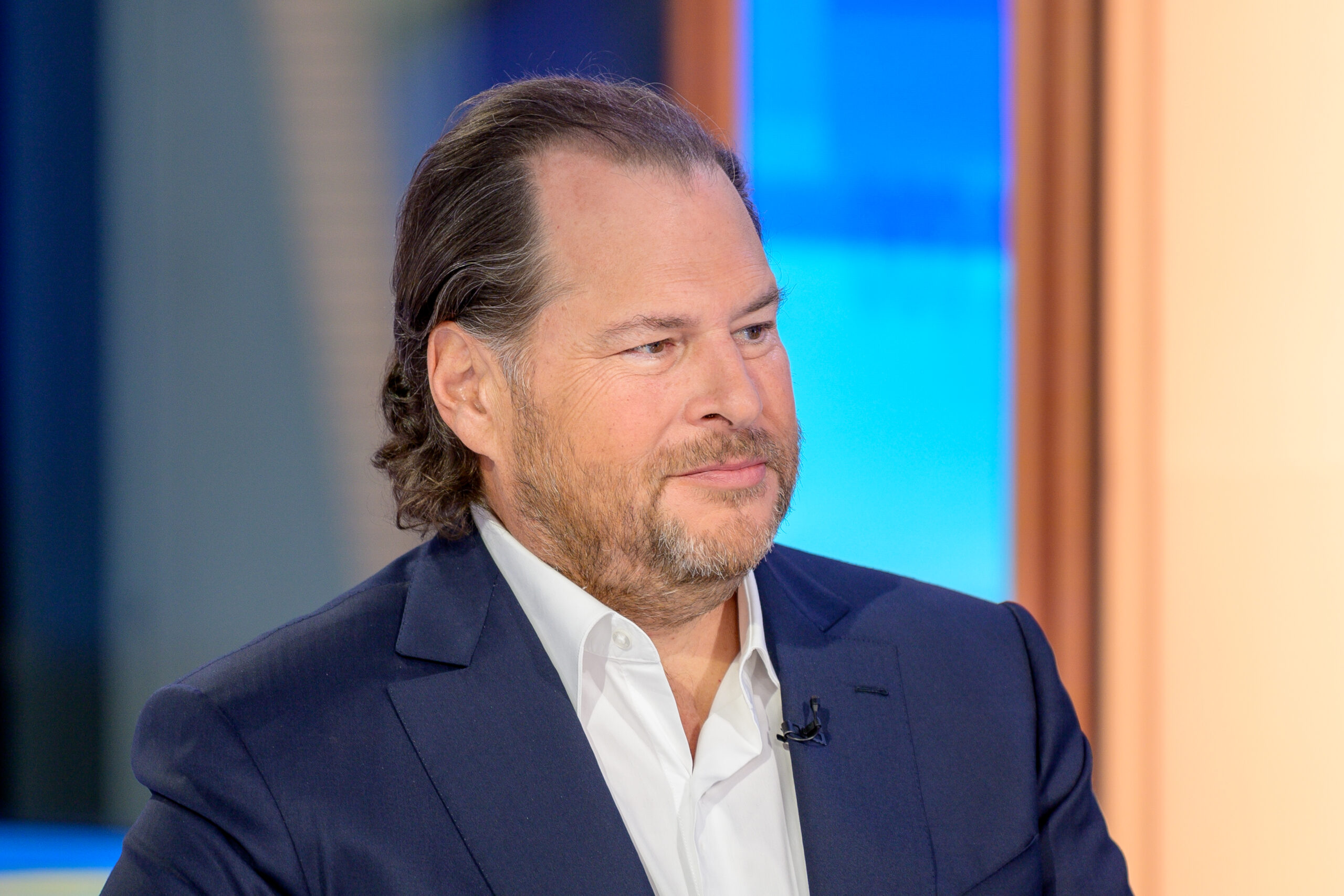

Salesforce shareholders voted against approving the company’s executive compensation plan, defying the board’s recommendation to endorse the payouts for top executives, including CEO Marc Benioff.

In a regulatory filing on Monday, it was revealed that the resolution to approve the compensation received 339.3 million votes in favor and 404.8 million votes against during the annual meeting on Thursday.

Why Did Advisory Firms Recommend Against the Plan?

The refusal to approve the compensation follows critiques from shareholder advisory firms, Glass Lewis and Institutional Shareholder Services, which both recommended that investors reject the plan.

This opposition largely stemmed from concerns over a significant equity award granted to CEO Marc Benioff in January. Benioff, who received a $20 million equity award from the board’s compensation committee, saw this as part of recognition for his leadership during the company’s “successful transformation actions and strong financial performance in the fiscal year,” according to the board’s justification.

How Much Did CEO Marc Benioff Earn?

Benioff’s total compensation for the fiscal year 2024 was $39.6 million, a substantial increase from $29.9 million in the previous year. Despite his base salary remaining constant at $1.55 million, the augmentation in his compensation package included additional stock and option awards, nonequity incentive plan compensation, and security fees that had not been previously invoiced to the company.

Glass Lewis expressed its concerns in its proxy paper, noting that “shareholders may reasonably be wary of the substantial discretionary equity grants” to Benioff. The firm pointed out the “lack of a fully convincing rationale” for these grants, considering Benioff’s existing 2% stake in Salesforce valued at nearly $6 billion, which arguably aligns his interests closely with those of the shareholders. The report from Glass Lewis suggested that the additional performance-based restricted stock units and stock options were “unwarranted.”

How Will the Board Address the Vote Outcome?

Following the shareholder vote, which is advisory and nonbinding, Salesforce’s board stated, “Our Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by our stockholders and will consider the outcome of this vote when making future executive compensation decisions.” The company, however, declined to comment further on the matter.

This shareholder decision comes in a fiscal year where Salesforce exhibited remarkable financial performance. The company’s shares rose 67% for the year ending January 31, 2024, marking the strongest performance since 2011. Salesforce reported a net income of $4.1 billion, up from $208 million a year earlier, with revenue increasing by 11% to $34.9 billion from $31.4 billion. Despite these strong financial outcomes, Salesforce shares have seen a 2.6% decrease year to date.

Earlier in January 2023, Salesforce announced it would lay off 10% of its employees as part of a restructuring effort prompted by activist investors demanding a better mix of profit and growth. In February, Salesforce announced it would begin paying a dividend to shareholders, reflecting a new approach to sharing profits directly with its investors.

Featured Image courtesy of Roy Rochlin/Getty Images