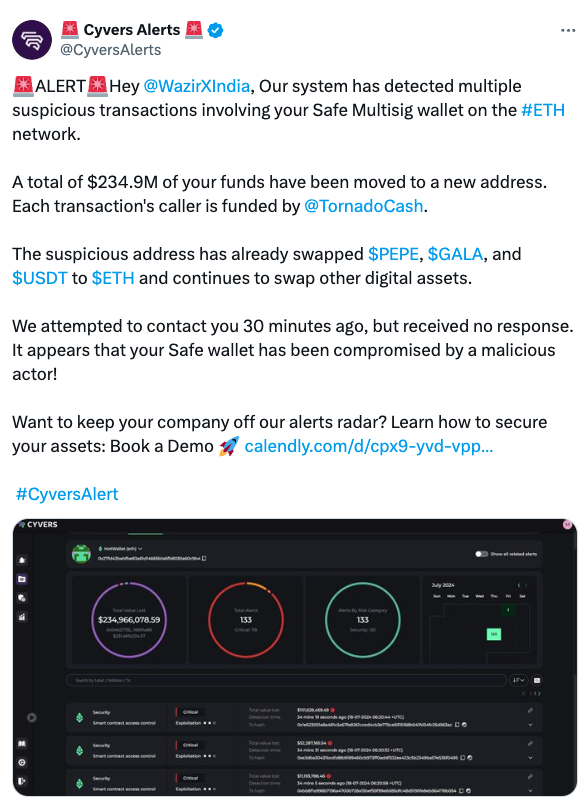

Web3 security firm Cyvers has identified several suspicious transactions involving WazirX’s Safe Multisig wallet on the Ethereum network. According to an X post by Cyvers, approximately $234.9 million worth of funds from the Indian crypto exchange’s wallet have been moved to a new address. Notably, each transaction’s caller was funded by Tornado Cash, a decentralized protocol designed for private transactions.

Movement and Conversion of Funds

The newly identified address has already converted the moved funds, including Tether (USDT), Pepe (PEPE), and Gala (GALA), into Ether (ETH). The transactions have raised significant concerns within the crypto community, prompting further investigation.

ZachXBT, a well-known crypto investigator, announced on the “Investigations by ZachXBT” Telegram channel that the suspected primary attacker’s address still holds over $104 million. Analyzing the address’s holdings revealed that the wallet is composed of:

- Shiba Inu (SHIB): Approximately $100 million

- Ether (ETH): $52 million

- Polygon (MATIC): $11 million

- FLOKI: $4.7 million

- Fantom (FTM): $3.2 million

- Chainlink (LINK): $2.8 million

- Fetch.ai (FET): $2.3 million

The remaining funds are distributed across various other tokens.

WazirX’s Response to the Security Breach

In light of the security breach, WazirX has taken immediate action by suspending all cryptocurrency and INR withdrawals on the platform. The exchange’s official X post stated that they are “actively investigating the incident” and will provide updates as more information becomes available.

| Token | Amount Held Post-Breach | Converted To Ether |

|---|---|---|

| Tether (USDT) | – | Yes |

| Pepe (PEPE) | – | Yes |

| Gala (GALA) | – | Yes |

| Shiba Inu (SHIB) | $100 million | No |

| Ether (ETH) | $52 million | No |

| Polygon (MATIC) | $11 million | No |

| FLOKI | $4.7 million | No |

| Fantom (FTM) | $3.2 million | No |

| Chainlink (LINK) | $2.8 million | No |

| Fetch.ai (FET) | $2.3 million | No |

| Other Tokens | Varied Amounts | No |

The breach at WazirX underscores the persistent risks and vulnerabilities in the cryptocurrency sector. As digital assets continue to gain popularity, the need for robust security measures becomes increasingly critical. Exchanges and wallet providers must constantly update and improve their security protocols to protect users’ funds from sophisticated cyber-attacks.

While WazirX continues its investigation, users are advised to:

- Monitor Updates: Keep an eye on official updates from WazirX regarding the status of the breach and the resumption of services.

- Review Security Practices: Reassess personal security measures, including using hardware wallets for significant holdings.

- Stay Informed: Stay informed about best practices for securing digital assets and be aware of common phishing and scam tactics.

Community and Industry Reactions

The crypto community has reacted strongly to the news, with many expressing concerns about the security of their assets on centralized exchanges. This incident may prompt a shift towards decentralized exchanges (DEXs) and the use of more secure, personal custody solutions.

To prevent similar incidents, exchanges are encouraged to:

- Enhance Security Protocols: Implement multi-layer security measures and regular audits.

- User Education: Educate users on securing their assets and recognizing potential threats.

- Collaboration with Security Firms: Work closely with blockchain security firms to identify and mitigate risks promptly.

The $235 million hack on WazirX serves as a stark reminder of the vulnerabilities inherent in the cryptocurrency industry. As investigations continue, the focus remains on securing the platform and restoring user confidence. The incident highlights the need for continuous vigilance and innovation in security practices to safeguard the future of digital finance.

Featured image credit: flatart via Freepik

Follow us for more breaking news on DMR