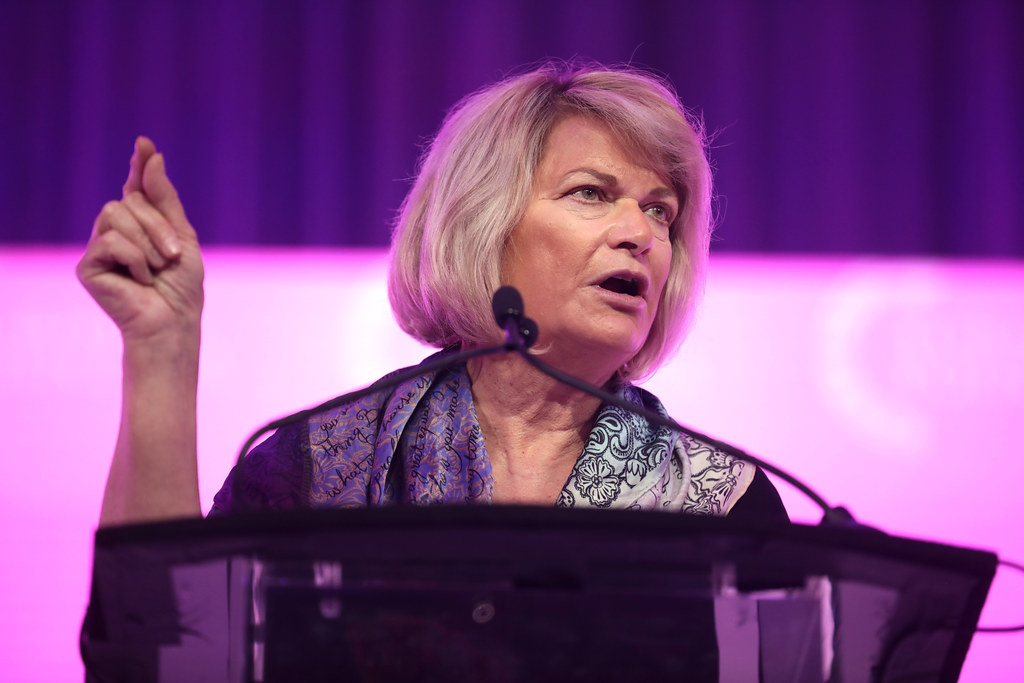

On July 31, Senator Cynthia Lummis officially introduced the Bitcoin Strategic Reserve bill, a legislative proposal aimed at establishing a reserve fund for Bitcoin, a scarce decentralized asset. The bill outlines a plan for the U.S. government to create a “decentralized network of secure Bitcoin vaults” under the management of the United States Treasury.

The proposed bill includes several key elements:

- Decentralized Bitcoin Vaults: Establishing a network of secure vaults managed by the U.S. Treasury.

- Cybersecurity and Physical Security Measures: Enacting stringent cybersecurity protocols and physical security measures to protect Bitcoin holdings from theft.

- Accumulation Goal: Aiming to acquire 1 million Bitcoin, or approximately 5% of Bitcoin’s total supply, using existing U.S. Treasury funds. This acquisition would mirror the U.S. Treasury’s gold allocation strategy.

Senator Lummis’ Statement

In conjunction with the bill’s introduction, Senator Lummis issued a statement underscoring the urgency of the proposal:

“As families across Wyoming struggle to keep up with soaring inflation rates and our national debt reaches new and unprecedented heights, it is time for us to take bold steps to create a brighter future for generations to come by creating a strategic Bitcoin reserve.”

This statement reflects Lummis’ belief that the strategic reserve could provide long-term financial stability and safeguard against economic uncertainties.

Protection of Self-Custody Rights

The bill also reaffirms the right to self-custody of Bitcoin in the United States. This aspect aims to protect individuals’ ability to hold and manage their own Bitcoin, a right that has faced scrutiny and potential restrictions from certain lawmakers.

Senator Lummis’ ambitious plan to acquire 5% of Bitcoin’s total supply has garnered attention and support from various political figures. Notable supporters include:

- Robert F. Kennedy Jr.: Echoed similar sentiments about the strategic acquisition of Bitcoin.

- Donald Trump: The Republican Party’s 2024 presidential candidate has hinted at the importance of Bitcoin in securing financial stability.

Despite this, controversy has arisen. Following former President Trump’s pledge not to sell any U.S. Bitcoin holdings, the government transferred 29,800 Bitcoin—valued at approximately $2 billion—to an unmarked wallet address. This move drew criticism from Galaxy Digital CEO Mike Novogratz, who described the action as “tone deaf.”

The current U.S. inflation crisis, exacerbated by the $35 trillion national debt, has sparked discussions about returning to hard assets like Bitcoin. Many believe that Bitcoin could offer a hedge against inflation and provide stability in the face of fiat currency depreciation.

Matt Bell, CEO of Turbofish, voiced his perspective on the matter. In a recent statement to Cointelegraph, Bell argued that concerns about the sustainability of fiat currencies are growing globally, driving interest in alternative assets like Bitcoin. His comments reflect a broader sentiment that Bitcoin could play a crucial role in addressing financial instability.

| Aspect | Details |

|---|---|

| Bill Introduction Date | July 31 |

| Proposed Bitcoin Vaults | Decentralized network managed by U.S. Treasury |

| Security Measures | Cybersecurity and physical security protocols |

| Acquisition Goal | 1 million Bitcoin (~5% of total supply) |

| Statement by Senator Lummis | Focus on combating inflation and national debt |

| Political Support | Robert F. Kennedy Jr., Donald Trump |

| Controversy | Transfer of 29,800 Bitcoin to unmarked address |

| Economic Context | U.S. inflation and $35 trillion national debt |

| Expert Opinion | Matt Bell on Bitcoin’s role in financial stability |

The Bitcoin Strategic Reserve bill marks a significant step in the integration of Bitcoin into U.S. financial strategy. Its introduction highlights ongoing debates about the future of digital assets and their role in addressing economic challenges.

Featured image credit: Gage Skidmore via Flickr

Follow us for more breaking news on DMR