Chinese technology companies, including Huawei and Baidu, as well as various startups, are actively stockpiling high bandwidth memory (HBM) semiconductors from Samsung Electronics in anticipation of potential U.S. export restrictions, according to three sources familiar with the matter. This surge in purchasing, which began earlier this year, has helped China contribute to approximately 30% of Samsung’s HBM chip revenue in the first half of 2024, one source revealed.

This proactive stockpiling shows China’s commitment to advancing its technological capabilities amid escalating trade tensions with the United States and other Western countries. These tensions are influencing the global semiconductor supply chain. Last week, Reuters reported that U.S. authorities are expected to introduce an export control package later this month, aimed at imposing new restrictions on semiconductor shipments to China.

The expected package is likely to outline specific parameters for limiting access to HBM chips, crucial for developing advanced processors such as Nvidia’s graphics processing units used in generative AI applications. The U.S. Department of Commerce declined to comment directly but stated that it continually assesses evolving threats and updates export controls to protect national security and the technological ecosystem. The precise details of the proposed HBM restrictions and their impact on China remain undetermined.

HBM chips are essential for the development of sophisticated processors, and only three major manufacturers produce them: SK Hynix and Samsung from South Korea, and U.S.-based Micron Technology. Chinese demand has primarily focused on the HBM2E model, which is two generations behind the latest HBM3E version, sources said. The global AI boom has strained the supply of advanced models.

Nori Chiou, investment director at Singapore-based White Oak Capital Partners, explained that due to the immaturity of China’s domestic technology development, the demand for Samsung’s HBM chips has surged, as other manufacturers’ capacities are fully booked by American AI companies. Although it is difficult to estimate the volume or value of HBM chips stockpiled in China, a wide range of businesses, including satellite manufacturers and tech firms like Tencent, have been purchasing them. One source noted that chip designing startup Haawking recently ordered HBM chips from Samsung. Additionally, Huawei has been using Samsung HBM2E semiconductors for its advanced Ascend AI chip, according to a source.

Samsung and SK Hynix declined to comment, while Micron, Baidu, Huawei, Tencent, and Haawking did not respond to requests for comment. The sources requested anonymity due to the sensitivity of the information.

Chinese firms have made some progress in developing HBM, with Huawei and memory chipmaker CXMT focusing on HBM2 chips, which lag three generations behind the HBM3E model, Reuters reported earlier. However, these efforts could be hampered by the new U.S. regulations.

The restrictions on HBM sales to China could impact Samsung more significantly than its competitors, who rely less on the Chinese market. Micron has avoided selling its HBM products to China since last year, and SK Hynix, whose primary HBM customers include Nvidia, concentrates more on advanced HBM chip production. SK Hynix announced earlier this year that it is adjusting production to expand HBM3E output, with its HBM chips already sold out for this year and nearly sold out for 2025.

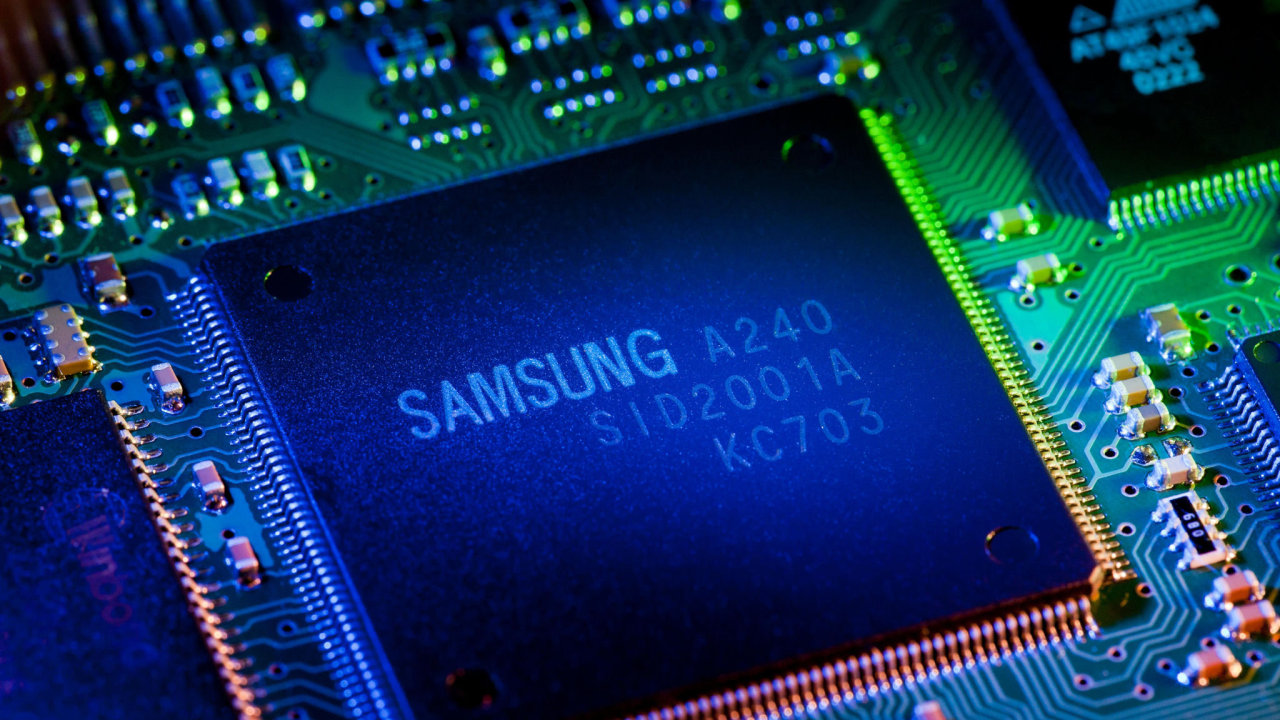

Featured Image courtesy of THE INVESTOR

Follow us for more updates on Samsung Chips.