In a significant move to bolster China‘s struggling real estate sector, several cash-strapped property developers, including Country Garden Holdings Co and Sunac China Holdings Ltd, have announced that a multitude of their housing projects have been deemed eligible for the latest government-backed financing support program. This initiative follows Beijing’s call for local governments to identify projects that qualify for funding, aiming to rejuvenate the sector by encouraging risk-averse banks to enhance lending.

Local Governments Rally to Support

Country Garden revealed that over 30 of its projects had been recognized by local authorities for financing support, with plans to secure inclusion in additional provincial government lists. Similarly, Sunac China disclosed that more than 90 of its developments were placed on so-called “white lists” by over 20 city governments. This surge in activity reflects the central government’s directive for local officials to proactively identify and support viable projects to stimulate the real estate market.

Central and Local Efforts to Coordinate Financing

The central government has established a “coordination mechanism,” urging major banks to compile a white list of property projects and directing local authorities to monitor progress closely. A recent report highlighted that 3,218 projects across 170 cities had been recommended for bank loans, with 83 projects already benefiting from a total of 17.9 billion yuan in loans.

Developers Respond to Policy Initiative

Amid these developments, several mid-sized developers, including Sino-Ocean Group Holding Ltd and Shimao Group Holdings Ltd, reported a significant number of their projects had been white-listed. The initiative sparked optimism in the stock market, with shares of Country Garden, Sino-Ocean, Shimao, and Sunac experiencing gains despite an overall decline in Chinese real estate stocks.

Funding Thresholds and Impact on Liquidity

The program is seen as a crucial step for residential projects facing immediate liquidity challenges to secure necessary funding. However, analysts express skepticism about the substantial impact of this support on developers’ overall liquidity, particularly for companies like Country Garden, which, despite having 30 projects shortlisted, faces broader financing challenges across its extensive portfolio.

One of the first projects to benefit from the initiative is Lotus Courtyard, a state-backed development in Guangxi province, which secured a 330 million yuan loan. This example underscores the potential for targeted support to facilitate project completion, though questions remain about the broader efficacy of these efforts in alleviating the sector’s cash crunch.

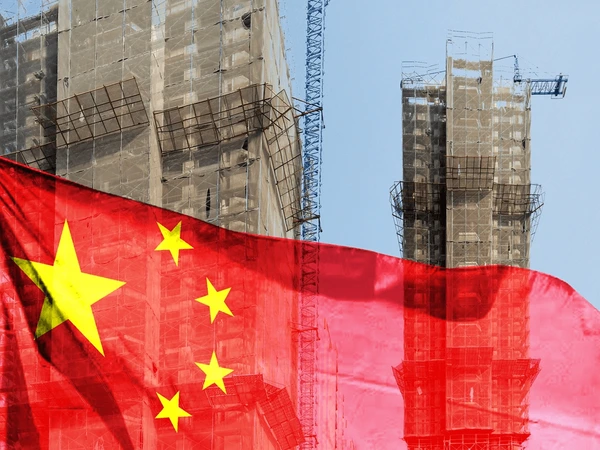

Featured image credit: Andy.LIU via Shutterstock