Nvidia, the leading chipmaker, has become a critical focus in the tech industry, labeled by some as the world’s “most important stock.” This heightened attention is largely due to its significant role in the artificial intelligence (AI) boom, which has seen the company’s market capitalization grow nearly ninefold since late 2022. However, Nvidia’s stock has experienced considerable volatility, including a sharp drop of almost 30% after hitting a record high in June. Currently, Nvidia’s shares are rallying again, nearing their all-time peak, as anticipation builds around its upcoming earnings report on Wednesday.

Nvidia’s financial performance is closely watched because of its dominance in the AI sector, particularly with its graphics processing units (GPUs) being critical for training AI models and managing large-scale computing tasks. In the last three quarters, Nvidia’s revenue has more than tripled, primarily driven by its data center business. For the upcoming report, analysts predict continued robust growth but at a slightly lower rate of 112% year-over-year, reaching $28.7 billion. Expectations are also high for Nvidia’s forecast for the October quarter, with projected growth of around 75% to $31.7 billion. Investor focus will be on Nvidia’s guidance, as optimistic projections could indicate sustained investment from major clients, while a cautious outlook might raise concerns about the sustainability of AI-related spending.

The relevance of Nvidia’s chips was underscored during recent earnings calls by major tech firms, including Microsoft, Alphabet, Meta, Amazon, and Tesla, all of which are heavily investing in Nvidia’s technology. Despite this optimism, questions remain about the long-term return on investment for Nvidia’s clients, given the high costs of its advanced chips. Nvidia’s Chief Financial Officer Colette Kress has previously indicated that cloud providers, accounting for more than 40% of Nvidia’s revenue, could see substantial returns, with every dollar spent on Nvidia chips potentially generating five dollars in revenue over four years.

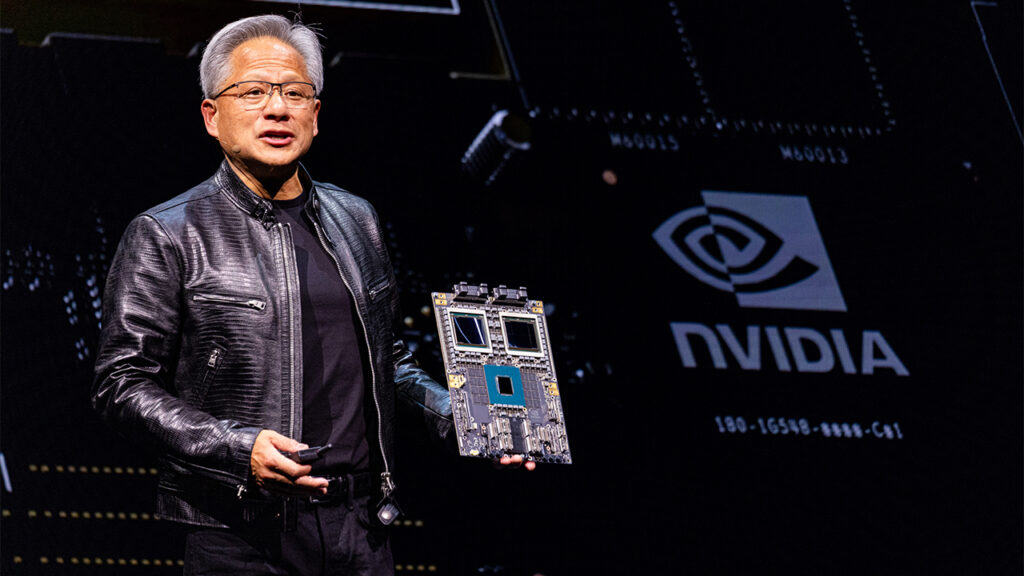

Another critical factor influencing Nvidia’s stock is the development and rollout timeline for its next-generation AI chips, known as Blackwell. Reports suggest potential production delays, pushing significant shipments into early 2025, though Nvidia has stated that production remains on track for the second half of this year. Despite these concerns, Nvidia’s existing Hopper chips, including the newer H200 variant, continue to be a top choice for deploying AI applications.

Investors are eagerly awaiting Nvidia’s upcoming earnings report, which will not only reveal the company’s financial performance but also potentially offer more details on future product timelines and return on investment metrics. The outcome will be closely watched, as Nvidia’s trajectory could have broader implications for the tech industry, especially amid the current AI boom.

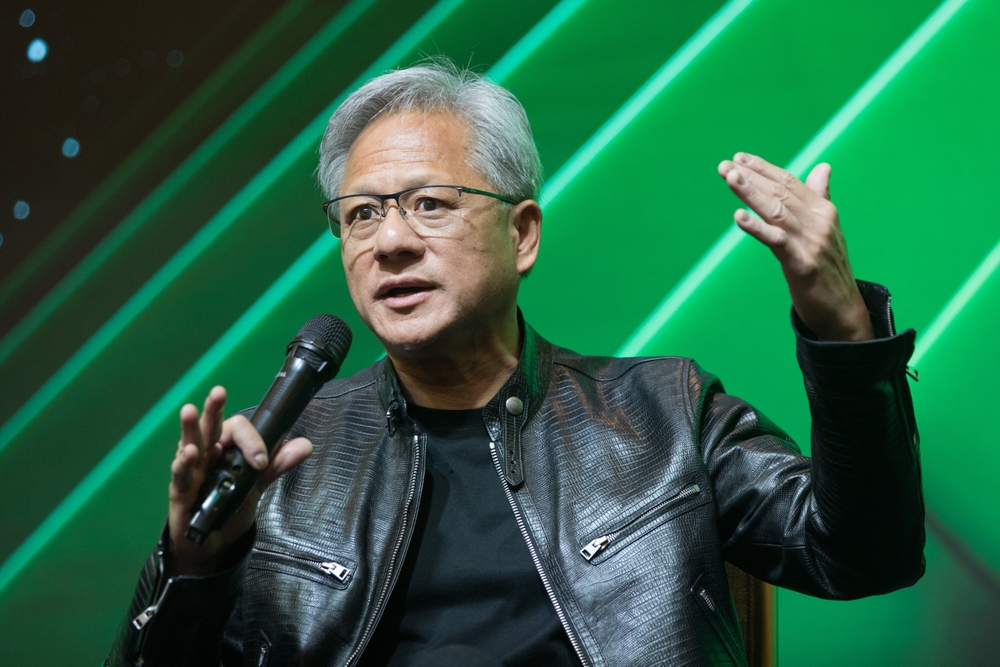

Featured Image courtesy of CEO Today

Follow us for more updates on Nvidia’s earnings.