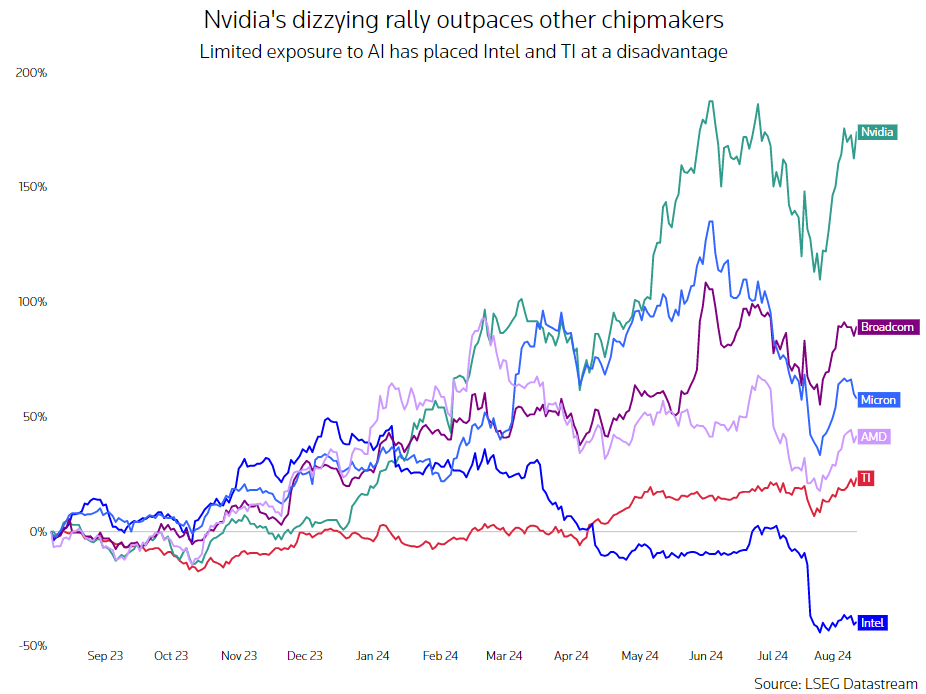

Intel’s long-standing presence in the Dow Jones Industrial Average is at risk as its share price continues to decline. The American chipmaker, which became one of the first tech companies to join the Dow during the dot-com boom of the late 1990s, is facing a potential removal from the blue-chip index. A near 60% drop in Intel’s shares this year has positioned it as the worst-performing stock on the Dow, which is a price-weighted index. This downturn has sparked concerns among analysts and investors about Intel’s future within the prestigious index.

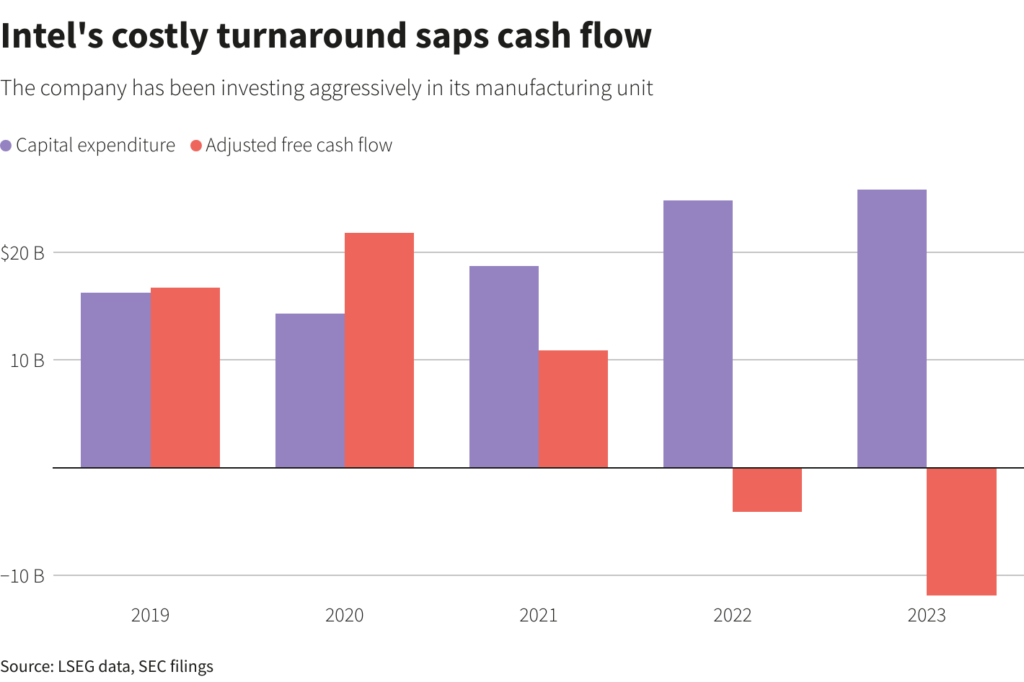

Intel’s shares fell approximately 7% on Tuesday amid a broad market selloff, with the Philadelphia SE Semiconductor Index also down nearly 6%. The decline followed reports indicating a decrease in global chip sales in July, which highlighted ongoing challenges in the semiconductor industry. If removed from the Dow, Intel’s already struggling reputation could suffer further. The company has lagged behind in the artificial intelligence sector, missing opportunities such as an investment in OpenAI, and is dealing with financial losses in its contract manufacturing unit. Intel has been expanding this unit in hopes of competing with Taiwan Semiconductor Manufacturing Company (TSMC).

In response to these challenges, Intel has implemented cost-cutting measures, including suspending dividend payouts and announcing layoffs affecting 15% of its workforce. These steps, revealed during the company’s recent earnings report, have been met with skepticism from some analysts and a former board member, who believe that these actions may be insufficient to reverse Intel’s declining fortunes. Ryan Detrick, chief market strategist at the Carson Group, noted that Intel’s removal from the Dow seemed inevitable, with the latest financial results potentially serving as the final catalyst.

Globally, semiconductor sales fell by 11.1% in July compared to June, a drop attributed primarily to declining memory chip sales, as reported by UBS Securities. Summit Insights Group analyst Kinngai Chan highlighted that Intel’s difficulties are compounded by unfavorable market demand and missteps in its product roadmap. To address these issues, Intel CEO Pat Gelsinger and key executives are expected to propose a plan later this month to streamline operations and reallocate capital spending.

The management of the Dow Jones Industrial Average, S&P Dow Jones Indices, has declined to comment on whether Intel will be removed. Changes to the index occur as necessary, with the most recent adjustment taking place in February when Walgreens Boots Alliance was replaced by Amazon. Stock price is a significant criterion for inclusion in the Dow, unlike the market value-based S&P 500 index. Currently, the highest-priced stock in the Dow, UnitedHealth Group, is priced about 29 times higher than Intel, which has the lowest price and is the least influential member with a weight of just 0.32%.

Intel’s potential exclusion from the Dow would not only damage its reputation but also likely impact its stock price further, which has already dropped more than 70% since a peak in August 2000. Its market value has now fallen below $100 billion for the first time in 30 years. Analysts have speculated on potential replacements, with Nvidia being a strong contender due to its significant gains this year and pivotal role in the generative AI industry. However, Nvidia’s volatility might be a concern for the stability-focused Dow. Texas Instruments, known for its stable performance and substantial U.S. production capacity, is another candidate being considered.

Featured Image courtesy of Tech Wire Asia

Follow us for more updates on Intel’s Dow Jone’s status.