The price of computer memory has more than doubled since October 2025, a shift that industry executives say could push up the cost of everyday electronic devices in 2026 as manufacturers struggle to absorb sharply higher component expenses.

Demand From AI Data Centres Drives Price Surge

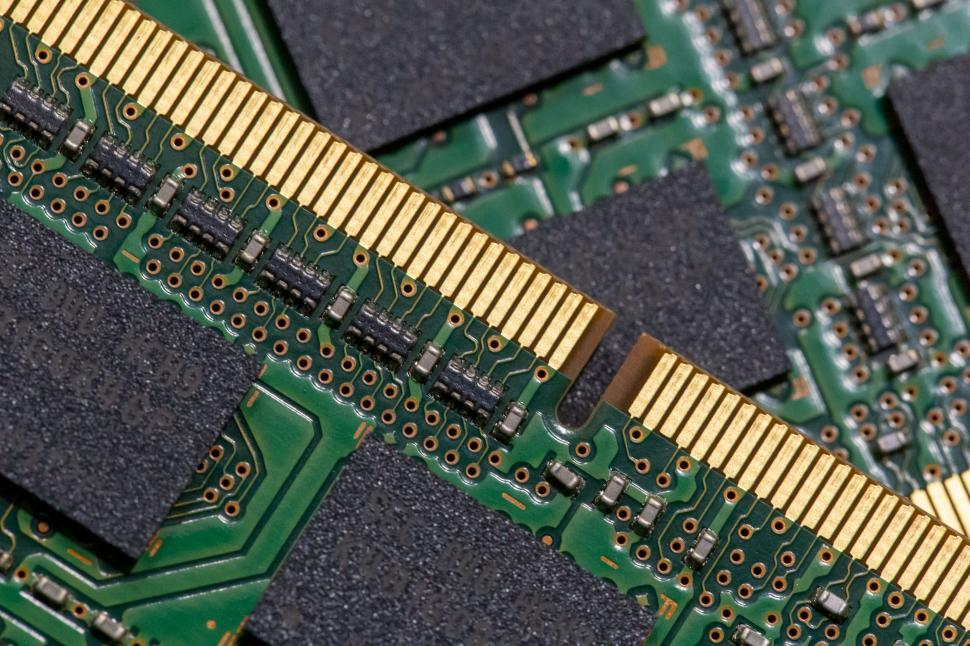

Random access memory, commonly known as RAM, powers products ranging from smartphones and smart televisions to medical equipment and personal computers. Prices have climbed rapidly as data centres that support artificial intelligence systems increase their demand for memory, tightening supply across the market.

Industry executives say the imbalance between supply and demand has accelerated price increases. Manufacturers often absorb modest cost rises, but the current scale of increases is creating pressure to adjust retail pricing.

Steve Mason, general manager of CyberPowerPC, said suppliers are now quoting memory costs several times higher than late 2025 levels. He said there would come a point where manufacturers would be forced to make pricing decisions as component costs rise.

Manufacturers Face Limited Room To Absorb Costs

Mason said any product that relies on memory or storage could be affected, leaving manufacturers and consumers with limited options. He added that decisions would need to be made about whether to pass higher costs on to buyers or adjust product specifications.

Danny Williams from PCSpecialist said memory prices are likely to remain elevated well into 2026. He said the market was strong throughout 2025 and warned that sustained high prices could dampen consumer demand next year.

Williams said the impact varies by supplier. Some memory vendors with larger inventories have raised prices by around 1.5 to two times, while others with less stock have increased prices by as much as fivefold.

Experts Point To AI As Primary Driver

Chris Miller, author of Chip War, said artificial intelligence has been the main factor behind the surge in memory demand. He said high-end High Bandwidth Memory used in AI systems has pushed up prices across different types of memory chips.

Miller said memory prices often fluctuate based on supply and demand, and demand is currently far above historical levels.

Mike Howard from Tech Insights said cloud service providers have recently finalised their memory requirements for 2026 and 2027. He said that clarity has given memory suppliers confidence that planned capacity will not meet demand from companies such as Amazon and Google.

Howard said some suppliers have raised prices steadily, while others have paused issuing quotes altogether, signalling expectations of further increases.

Impact On Device Manufacturing Costs

Howard said memory typically accounts for 15 to 20 percent of the total cost of a personal computer, but rising prices have pushed that share closer to 30 to 40 percent. He said profit margins in most consumer electronics categories are too thin to absorb increases of that scale.

He added that a standard laptop with 16GB of memory could see manufacturing costs rise by $40 to $50 in 2026, with those costs likely passed on to buyers. Smartphones could also face higher build costs of around $30 per device.

Shifts In Supplier Focus Reduce Consumer Options

Some manufacturers have already shifted away from consumer markets. In December, Micron said it would stop selling its Crucial consumer memory brand to focus on AI-related demand.

Mason said Micron’s decision removes a major supplier from the consumer market, reducing choice. He added that concentrating production on AI could free up capacity for other vendors, potentially easing pressure over time.

Consumers May Delay Upgrades

Williams said higher memory prices could change consumer behaviour. He said buyers may choose to pay more for the performance they need, accept lower specifications, or keep existing devices for longer.

Mason said industry intelligence suggests pricing and supply challenges are likely to persist globally through 2026 and into 2027.

Featured image credits: Freerange Stock

For more stories like it, click the +Follow button at the top of this page to follow us.