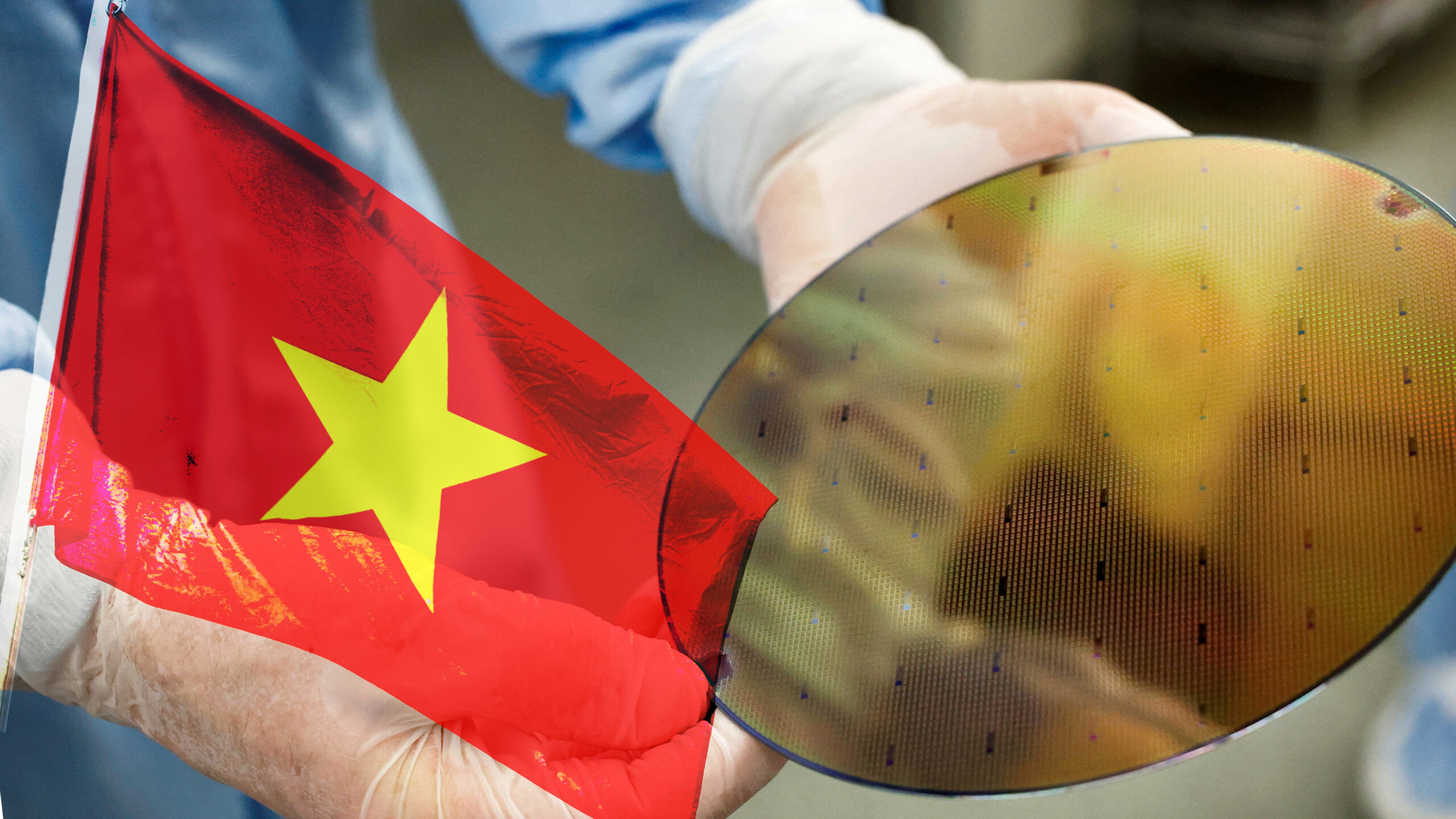

Vietnam is rapidly expanding its footprint in the semiconductor back-end manufacturing sector, attracting foreign investment as companies reduce operations in China due to escalating trade tensions with Western nations. Foreign companies and domestic firms alike are investing in testing and packaging chips in Vietnam, signaling the country’s growing role in the $95 billion semiconductor back-end segment, which remains dominated by China and Taiwan. This shift is evident as companies focus on the less capital-intensive back-end of chip manufacturing, with testing and packaging seen as more feasible compared to the strategic and costly front-end foundries.

South Korean company Hana Micron is investing approximately 1.3 trillion won ($930 million) in its Vietnam operations through 2026 to meet industrial demand from clients seeking alternatives to China. Cho Hyung Rae, Hana Micron’s vice president for Vietnam, noted that the expansion aims to address customer requests for relocating production capacity. U.S.-based Amkor Technology, a major player in semiconductor packaging, also announced a $1.6 billion investment to build a 200,000-square-meter factory in Vietnam. The new facility is expected to become Amkor’s largest and most advanced, incorporating next-generation semiconductor packaging capabilities. According to a company executive, some equipment for the factory has been relocated from Amkor’s Chinese plants, though the company declined to comment on the transfer specifics.

Intel, which operates its largest global chip back-end facility in Vietnam, displayed its technology at Vietnam’s inaugural international semiconductor exhibition near Hanoi, underscoring the sector’s growth. Supported by the Biden administration, Vietnam’s growth in the chip packaging and testing segment aligns with Washington’s strategy amid heightened trade tensions with Beijing. Projections by the U.S. Semiconductor Industry Association and Boston Consulting Group suggest that by 2032, Vietnam’s share of the global chip assembling, testing, and packaging market will reach 8% to 9%, up from just 1% in 2022.

Vietnamese companies are also moving into the semiconductor space. FPT, a leading tech company, is building a 1,000-square-meter testing facility near Hanoi, aiming to begin operations next year with an initial set of 10 testing machines. According to corporate sources, FPT plans to increase the number of testing machines by 2026 with an investment of up to $30 million and is actively seeking strategic partners for this endeavor. Meanwhile, Sovico Group, a local investment firm, is exploring co-investment opportunities for a new ATP facility in the coastal city of Danang. Viettel, a state-owned defense and telecoms company, is planning to establish Vietnam’s first chip foundry, a significant step toward Vietnam’s goal of launching a semiconductor fabrication plant by 2030.

Featured image courtesy of Nikkei Asia

Follow us for more updates on Vietnam’s chip production.