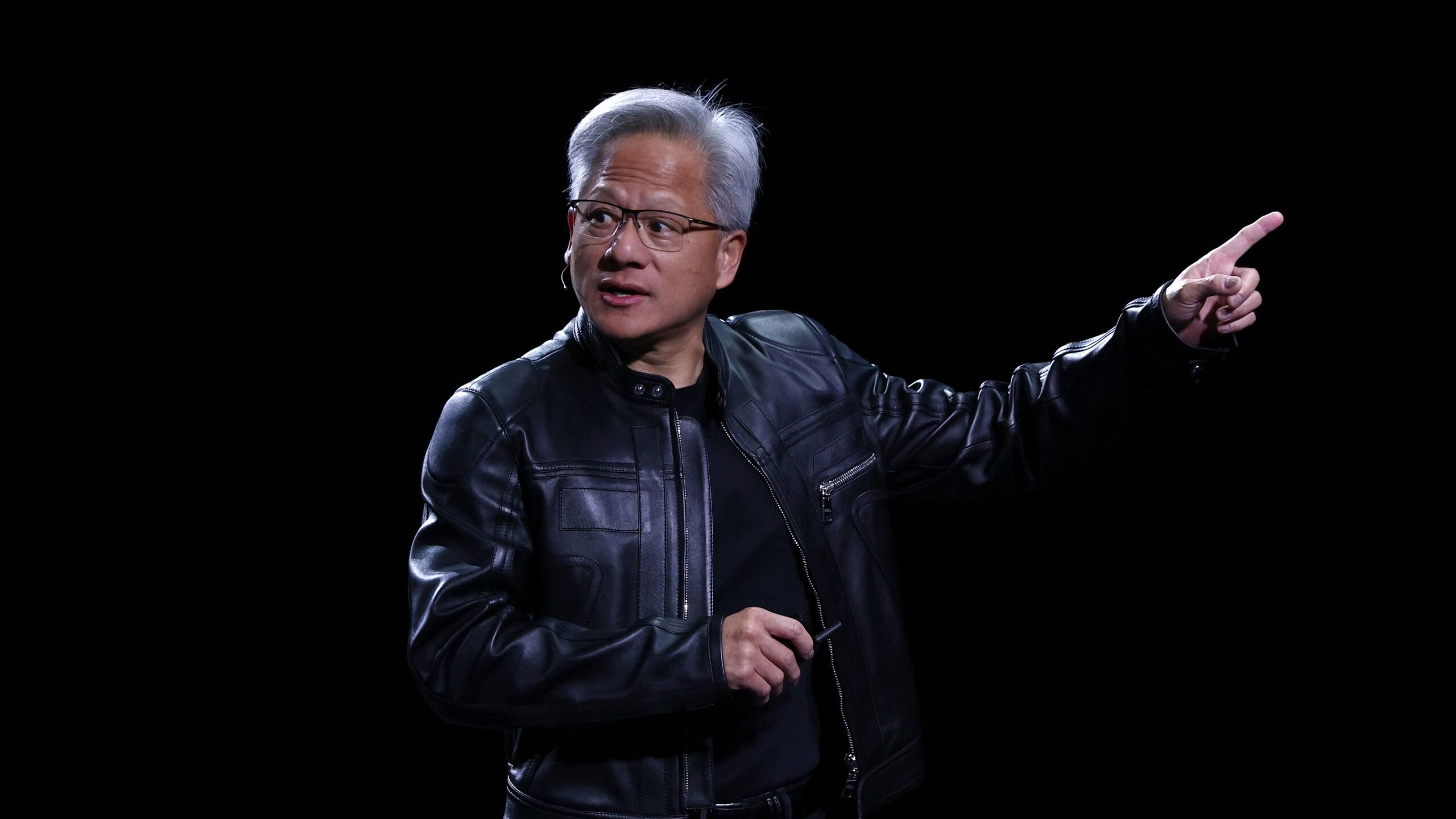

Nvidia CEO Jensen Huang expressed surprise on Wednesday that rival Advanced Micro Devices (AMD) offered a 10% equity stake in the company to OpenAI as part of their multibillion-dollar partnership announced earlier this week. Speaking on “CNBC’s Squawk Box,” Huang commented on the deal’s structure: “It’s imaginative, it’s unique and surprising, considering they were so excited about their next-generation product. I’m surprised that they would give away 10% of the company before they even built it. And so anyhow, it’s clever, I guess.”

The AMD-OpenAI Financial Alignment

The deal, formalized on Monday, involves OpenAI committing to purchase 6 gigawatts (GW) worth of AMD chips over multiple years, including its forthcoming MI450 series GPU. In exchange for this massive commitment, OpenAI will receive warrants for up to 160 million AMD shares. If OpenAI exercises the full warrant, the company would acquire roughly 10% ownership in AMD. The vesting of this stake is tied both to deployment volume and specific AMD share price milestones, with the final tranche vesting only if the stock reaches $600 per share. The market reacted strongly to the news, with AMD shares soaring 11% on Wednesday and a staggering 43% so far this week, while Nvidia shares rose 2% following Huang’s public comments.

Contrasting Deals and Funding Concerns

The AMD deal is a direct challenge to Nvidia’s dominance in the artificial intelligence chip industry, a market where AMD has been fighting to gain ground against both Nvidia and competing cloud providers developing their own silicon. Late last month, Nvidia announced a plan to invest up to $100 billion in OpenAI over the next decade. This partnership requires OpenAI to build and deploy Nvidia systems requiring 10 GW of power.

Huang stressed that Nvidia’s investment is “very different” from the AMD deal because it allows Nvidia to sell directly to the ChatGPT creator. This direct relationship underscores concerns among market watchers about the “circular nature” of some AI infrastructure deals, where the chip vendor funds its own customer. When asked how OpenAI would fund its deal with Nvidia, Huang admitted, “They don’t have the money yet.” He clarified that OpenAI would have to raise the capital through growing exponential revenues, equity, or debt, and that OpenAI “gave us the opportunity to invest alongside other investors when the time comes.” Huang added that after Nvidia’s previous investment in OpenAI, his “only regret is that we didn’t invest more.”

Huang also confirmed Nvidia’s involvement in the latest funding round for xAI, Elon Musk’s startup, which is reportedly seeking to raise about $20 billion. Bloomberg reported that Nvidia is set to invest $2 billion. Huang expressed strong enthusiasm for the opportunity, saying he is “super excited” and wished he could give Musk more money, adding, “Almost everything that Elon is part of, you really want to be part of as well.” Huang also highlighted Nvidia’s backing of AI data center operator CoreWeave, describing these ventures as “terrific investments” that are part of Nvidia’s ecosystem dedicated to building out the global AI infrastructure.

What The Author Thinks

The structure of the AMD-OpenAI deal, which effectively sacrifices a 10% equity stake to secure massive future revenue, is a desperate but clever move by the challenger to break the Nvidia monopoly. Huang’s feigned surprise, contrasting it with Nvidia’s cash-rich investment model, masks the true nature of the rivalry: the AI race is now a fight for supply chain control. By taking a stake in AMD, OpenAI is diversifying its hardware dependency, gaining pricing leverage, and transforming its supplier into a committed strategic partner, confirming that the ultimate goal is not just to buy chips, but to vertically integrate and ensure no single vendor controls the destiny of the world’s most valuable AI company.

Featured image credit: Heute

For more stories like it, click the +Follow button at the top of this page to follow us.