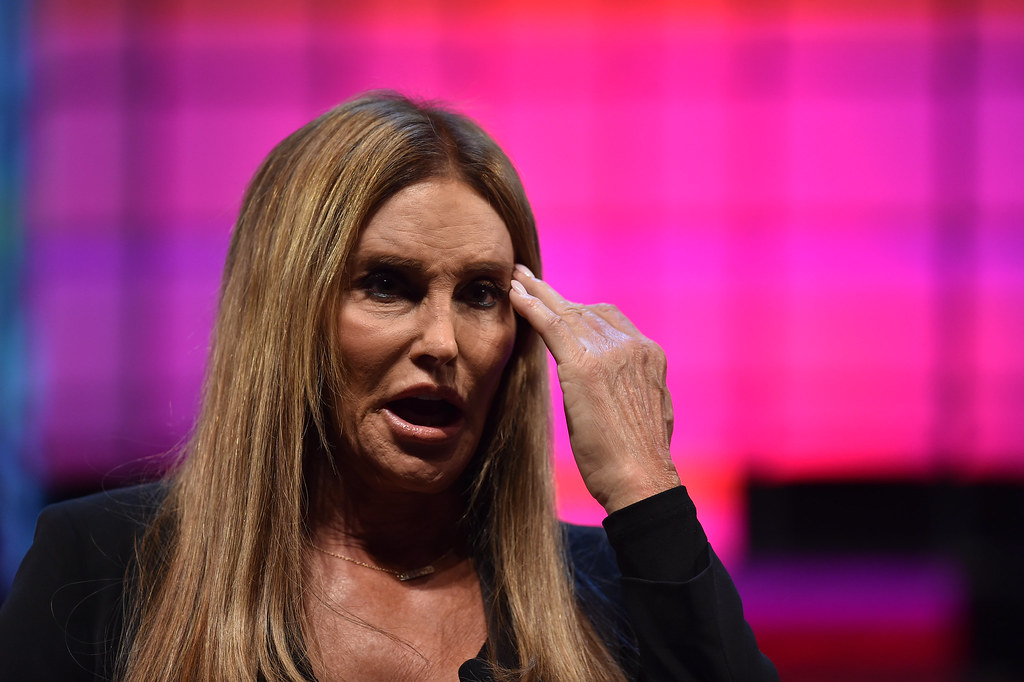

On November 13, a class-action lawsuit was initiated by Naeem Azad and Mihai Caluseru, citizens of the United Kingdom and Romania, respectively. Filed in a California federal court, the suit accuses Caitlyn Jenner and her manager Sophia Hutchins of misleading investors into buying JENNER, a memecoin marketed as a celebrity token, which they claim was promoted as an unregistered security.

The plaintiffs allege that Jenner and Hutchins targeted financially naive investors, both domestically and internationally, convincing them to invest in JENNER tokens issued on Ethereum and Solana blockchains. They claim to have lost over $56,000, attributing their decision to invest to “false and misleading statements and omissions” made by Jenner. They contend that Jenner failed to register the token with the Securities and Exchange Commission (SEC), depriving investors of essential information needed to assess investment risks.

Token Launch and Market Performance

JENNER was initially launched on the Solana platform through memecoin creator Pump.fun in May but quickly became mired in controversy. Following accusations against collaborator Sahil Arora of scamming, Jenner relaunched the token on Ethereum. Since its launch, the Ethereum-based JENNER token has seen its value collapse, reaching an all-time low on November 13, with its market capitalization plummeting to $170,000 from nearly $7.5 million and recording a negligible trading volume of just $1.80 over the past day.

The lawsuit emphasizes Jenner’s alleged abandonment of the project and her failure to disclose risks associated with the token’s market performance. It specifically points to Arora’s actions of selling a significant portion of tokens, which precipitated a market crash—a risk they claim Jenner should have disclosed. The suit further accuses Jenner of implementing undisclosed transaction taxes on the Ethereum token, which purportedly enriched her significantly while devaluing the original Solana token.

| Event | Date | Description |

|---|---|---|

| Initial Launch of JENNER on Solana | May | Initial release followed by controversy and relaunch |

| Relaunch on Ethereum | Post-May | Followed by significant loss in token value |

| Discovery of Financial Losses by Plaintiffs | November 13 | Losses highlighted amid all-time low token value |

| Filing of Class-Action Lawsuit | November 13 | Lawsuit alleges fraud and securities violations |

The allegations against Jenner highlight significant issues within the cryptocurrency industry, particularly concerning celebrity endorsements and the responsibilities these figures may hold. The case underscores the potential risks for investors and the need for clearer regulatory guidelines on the promotion and sale of crypto-related securities.

The Need for Stringent Crypto Regulations

The lawsuit against Caitlyn Jenner over the JENNER memecoin serves as a stark reminder of the volatile and often murky waters of the cryptocurrency market, particularly when celebrity-endorsed projects are involved. This case not only reflects the risks associated with such investments but also underscores the urgent need for more stringent regulatory oversight. As cryptocurrencies continue to intersect with mainstream culture, the potential for misuse remains high, making it imperative for regulatory bodies like the SEC to enforce existing securities laws rigorously and consider new measures to protect unsophisticated investors from misleading schemes that could lead to significant financial losses. The development of comprehensive guidelines and stricter enforcement can help mitigate risks, ensuring a safer investment landscape for all parties involved.

Featured image credit: Sportsfile via Flickr

Follow us for more breaking news on DMR