Apple has selected JPMorgan Chase as the new issuer of the Apple Card, replacing Goldman Sachs, with the transition expected to take up to 24 months and no immediate changes for cardholders.

Issuer Change Confirmed After Long-Running Reports

On Wednesday, Apple announced that JPMorgan Chase will take over as the issuing bank for the Apple Card. The company said the transition process will likely take as long as two years to complete.

Despite the change in banking partner, Apple said the Apple Card will continue to operate on the Mastercard network. Apple added that there are no immediate changes for existing cardholders or for customers applying for new Apple Cards during the transition period.

Financial Impact On JPMorgan And Goldman Sachs

JPMorgan said the agreement will bring more than $20 billion in credit card balances onto its books. According to reporting from The Wall Street Journal, Goldman Sachs is transferring those balances at a discount of approximately $1 billion.

Goldman Sachs separately disclosed that it expects to record a $2.2 billion provision for credit losses in the fourth quarter of 2025. The provision is tied to a forward purchase commitment connected to the Apple Card portfolio.

Background Of The Apple Card Partnership

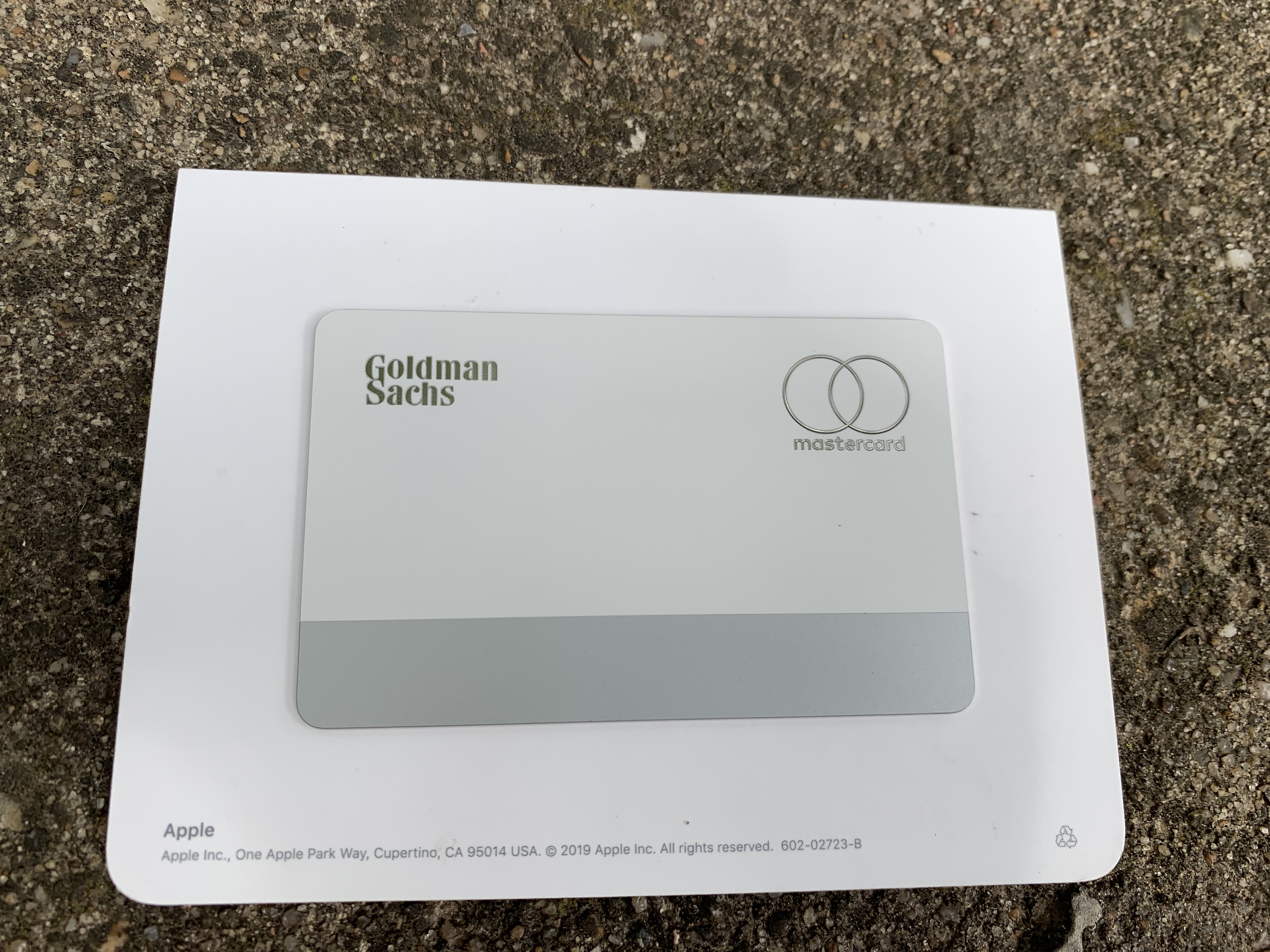

Apple introduced the Apple Card in 2019 in partnership with Goldman Sachs. At launch, the card was positioned without late fees or penalty interest rates. It offers daily cash back rewards, including up to 3 percent on purchases from Apple and select partners, 2 percent on purchases made using Apple Pay, and 1 percent on transactions made with the physical card.

Reports that Apple and Goldman Sachs would end their partnership have circulated for several years. In 2025, The Wall Street Journal reported that JPMorgan Chase was the leading candidate to assume the role of Apple’s new card issuer.

Featured image credits: Wikimedia Commons

For more stories like it, click the +Follow button at the top of this page to follow us.